Vendors Ignore Calls For Innovation In Assays

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Fewer vendors committed to improved testing and assay services

Our column last month discussed biomanufacturers’ increasing demand for better analytical-methods development for process monitoring, comparability analytics, and other critical areas associated with process improvement. More than one-fourth of respondents to our 10th Annual Report and Survey of Biopharmaceutical Manufacturers find an urgent need for new or improved testing methods across eight assay areas (see: http://www.bioplanassociates.com/10th). This is also mirrored in the opinions of the 450 global subject matter experts and industry manufacturers on our Biotechnology Industry Council. Our council of industry experts this year identified assay development and analytical methods as one of the top critical trends for 2013.

Our column last month discussed biomanufacturers’ increasing demand for better analytical-methods development for process monitoring, comparability analytics, and other critical areas associated with process improvement. More than one-fourth of respondents to our 10th Annual Report and Survey of Biopharmaceutical Manufacturers find an urgent need for new or improved testing methods across eight assay areas (see: http://www.bioplanassociates.com/10th). This is also mirrored in the opinions of the 450 global subject matter experts and industry manufacturers on our Biotechnology Industry Council. Our council of industry experts this year identified assay development and analytical methods as one of the top critical trends for 2013.

Our studies surprisingly show a disconnect between what the industry wants and what suppliers are investing in. Today, biopharma companies are generally dissatisfied by the slow pace of innovation in assay development. In the face of these calls for greater innovation, it appears that fewer vendors are looking at improved assaytesting services this year, according to data from our industrywide global study. What’s more, the lack of commitment on the part of vendors continues a trend we saw last year. Investments by suppliers into development of better assay technologies are down, possibly and simply because improvements are technically difficult. Improving assays for characterization of large molecules or developing single-use sensor technologies that work under multiple manufacturing conditions is not easy.

Surprisingly Low Stats For Assay Innovation

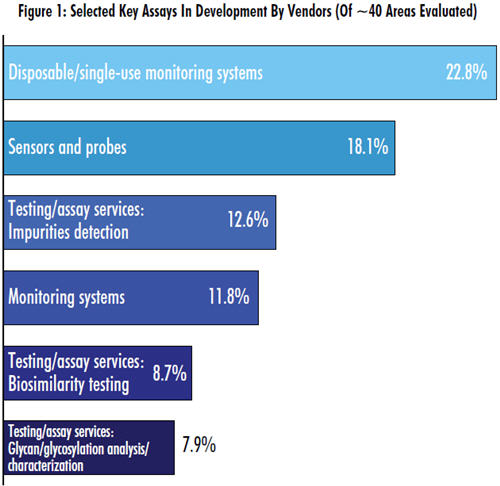

As part of our study, we asked vendors to identify the top new technologies or new product-development areas their company is working on in biomanufacturing. Of the nearly 40 areas identified, 11 pertained to assaytesting services. Discouragingly, no more than about 1 in 10 vendors we surveyed was innovating in any of those areas. By comparison, almost 4 in 10 are developing new bioprocess development/optimization services/ bioprocess modeling technologies.

In addition to low investment levels, fewer vendors are developing improved assay testing across several areas. The following list captures the downward trend in interest for those testing/assay services areas:

- Glycan/glycosylation analysis/characterization: 7.9% indicating some work on innovation in this area this year, down from 9.6% last year and 11.4% in 2011

- Cell-line testing: 7.1% this year, compared to 8.3% in 2012 and 15.8% in 2011

- GMP cell-bank development: just 3.1% this year, from 6.4% last year and 11.4% in 2011

The only areas that indicated somewhat constant levels of innovation interest this year compared to last year are impurities detection, raw-materials testing, biosimilarity testing, and structural analysis.

It is particularly interesting to see that there has been no rise in the percentage of vendors who are working on improvements to biosimilarity testing. This was one of the key subtrends identified by our council panel of experts, due to its potential to reduce the costs of biologic manufacturing. A number of respondents noted the technical and operational difficulties associated with such new assay development. For example, the fact that there does not exist today a consensus on what constitutes similarity in itself is a challenge. Further, as analytical technologies improve, so does our ability to understand structural attributes that define therapeutic protein drugs. Some see this as creating a dilemma — gaining such knowledge helps de-risk biosimilar programs, but such specific measurement capabilities may create an impossibly difficult path to biosimilar product development. Demonstrating biosimilarity on the basis of critical-product attributes will require better analytical methods. But as better information emerges, the definitions of biosimilarity may change as well, thus setting up a moving target.

Why Aren’t Suppliers Investing More In Assays?

The data paints a clear picture of declining numbers of suppliers interested in investing in challenging assay innovation. This is a curious trend, given that it counts as one of the strongest areas of opportunity we’ve noted this year. It could be that there is simply more low-hanging fruit in areas such as single-use devices, downstream processing, automation software, simpler sensor technologies, etc. Despite the fact that fewer vendors are investing resources into assays, the demand for solutions will continue to grow. Ultimately, solutions will be found. Whether these come from established industry suppliers or new industry entrants remains to be seen.

Survey Methodology: The 2013 Tenth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production is an evaluation by BioPlan Associates, Inc. that yields a composite view of and trend analysis from 300 to 400 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The respondents also include more than 185 direct suppliers of materials, services, and equipment to this industry. Each year the study covers issues including new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.