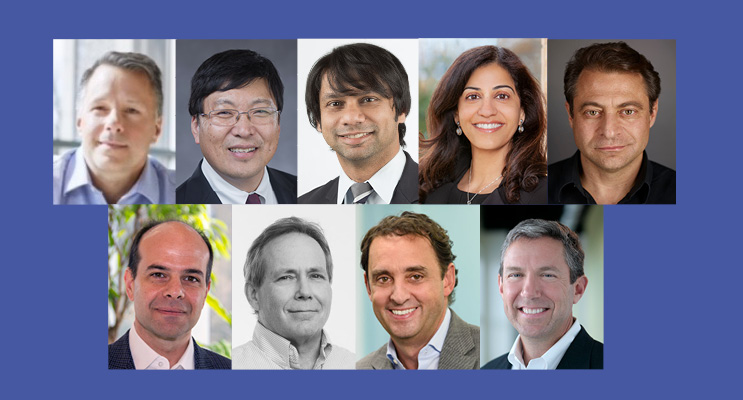

What 9 Biopharma Trendsetters Expect For 2020 – And Beyond

By Rob Wright, Chief Editor, Life Science Leader

Follow Me On Twitter @RfwrightLSL

Meteorologists accurately predict a five-day weather forecast about 90 percent of the time. I imagine we’d be pretty pleased if we had a similar rate of success regarding the predictions made from our biopharma industry thought leaders in this annual CEO outlook article. Of course, there is a big difference between predicting the weather five days out and predicting what will take place in the biopharma industry in 2020 and beyond. And while AI, machine learning (ML), and quantum computing will someday improve our ability to forecast the future, for now Life Science Leader continues to seek knowledge from a cross section of life sciences industry execs. We hope their wisdom provides the insight necessary for you to make the best business decisions possible.

Q: What Are The Three Most Important Issues Biopharma Employees Should Pay Attention To In 2020, And Why?

A: Doug Treco, Ph.D. President, CEO, and Cofounder, Ra Pharma

- Drug Pricing And Healthcare: In the run-up to the 2020 election, we can expect proposals to reduce overall drug and healthcare costs. These proposals, whether realistic or not, will roil markets and have a negative effect on the financing and valuation of biopharma companies.

- Immigration: The preeminence of U.S. science and biotechnology is, in great part, due to the contributions of immigrant scientists and our history of welcoming them. Companies seeking to hire foreign nationals may experience more difficulty, higher legal costs, and longer waits in obtaining visas for prospective employees, as well as a continued reduction of applications from international scientists to enter the U.S. due to administration policies, nationalistic biases, and fear.

- Regulatory Flexibility: Expect to see the FDA continue to lead the world in the advancement of regulatory science and the evolution of the regulatory framework to adapt to new technologies. We should see further innovation around novel endpoints for clinical trials, pathways to accelerated approval, and master trial protocols that will enable multiple diseases (i.e., “basket trials”) or multiple drugs (i.e., “platform trials”) to be assessed simultaneously in a single study. We’re also finally reaching the point where novel digital and wearable technologies are being incorporated into clinical trial endpoints, providing a new and intuitive way of assessing how patients respond to drugs in their daily lives.

Q: What Technology Are You Paying Closest Attention To, And How Do You Anticipate It Impacting Biopharma In 2020 And Beyond?

A: Spencer Williamson President and CEO, Kaleo

Over 50 percent of patients are not compliant with their drug regimen. Digital health linked with drug delivery has the potential to improve compliance and adherence while also providing broad benefits to multiple stakeholders. During clinical trials, data capture could be vastly improved though digital health. Once on the market, digital health has the potential to ensure that a real-life patient experience more closely matches the clinical study results. Stakeholder benefits are multifaceted. Most important is that the patient is taking their drug compliantly to increase the probability of improved clinical outcomes. Caregivers benefit from peace of mind that their loved one is taking their therapy on the appropriate regimen. Physicians benefit from the data to monitor medical conditions and personalize patient care. Payors benefit from the data to demonstrate clinical value and cost savings. Collaboration across the many stakeholders in healthcare is important to improving care and reducing healthcare costs; digital health synchronized with drug delivery holds promise to advance this collaboration in meaningful ways.

Q: How Do You Anticipate The U.S.- China “Tariff War” And Other Moves Of “Nationalism” Impacting Biopharma In 2020 And Beyond?

A: Yutaka Niihara, M.D. CEO and Chairman, Emmaus Life Sciences

The research and development of biopharma therapeutics requires a collaborative effort, oftentimes involving individuals across various nations. While protecting trade secrets can be very important, the U.S.-China tariff war could potentially disrupt joint R&D efforts by instilling regulations that hinder the ability to share important materials or resources. Improving the livelihood of patients should be a global movement, and it is possible that countries following a more independent track could disrupt the forward movement of therapeutic research and development. This is an important trend to observe over the next few years as our knowledge and capabilities in healthcare continue to expand.

Q: What Is Your Biggest Biopharma Industry-Related Concern?

A: Vincent Milano CEO, Idera Pharmaceuticals

Our biggest challenge is overcoming our image and the perceptions of the value biopharma delivers to society. As an industry, we have not done ourselves any favors by focusing the majority of the discussion on how much it costs to develop new medicines. The common narrative in the media and politics is that we don’t care about patients and their diseases, but only profits. Over the decades, biopharma has brought medicines to the marketplace that have not only prevented life-threatening diseases, but have saved, extended, and improved the quality of life for countless patients. Though biopharma has been incentivized (particularly in the U.S.) by IP laws and novel regulatory pathways to develop these new and innovative therapeutics, there is still enormous financial risk, which tends to be overlooked by the media, politicians, and society as a whole. While the true value of our industry comes from bringing new medicines to patients, biopharma still needs to achieve a positive return on investment (much of which will be reinvested in other potentially life-changing drugs). This is why, in the U.S., we have a limited and defined period of branded exclusivity before allowing generic competition. And as more than 85 percent of current U.S. prescriptions are generic versions of branded drugs, you can see the value biopharma innovation brings to society. But without the branded products to begin with, there would be no generics, and those saved, extended, and improved patient lives would not have occurred. If we hope to change the narrative of biopharma’s immense value to society and become more widely appreciated, then all of us who have committed our careers to this industry have an obligation to tell this story to as many people outside our industry as possible, including elected officials.

Q: What U.S. Trend Will Have The Biggest Impact On Biopharma In 2020 And Beyond?

A: Sheila Gujrathi, M.D. Cofounder and CEO, Gossamer Bio

The increased focus on creating constructive dialogue and guidance between the FDA and industry players could be the biggest trend in the coming years within U.S. biopharmaceuticals. Regulatory agencies are helping to facilitate this by challenging the industry to do the correct type of clinical work, while, wherever possible, permitting adaptive study design to avoid huge drug development price tags. This is especially important in larger indications, where the CAPEX barriers to entry have become increasingly high. If the relationship between the FDA and the industry it regulates fails to continue to evolve, the U.S. risks becoming globally deprioritized, and American patients will suffer. Further, innovation will occur outside of U.S. borders under the purview of nimbler countries that are welcoming of forward-thinking concepts. The FDA has done well in considering ideas and communicating guidance to industry, and continuation of this pattern positions the United States well for continued leadership within the global pharma industry.

Q: How Do You Anticipate The Current State Of U.S. Political Affairs Affecting Biopharma In The U.S. And Globally In 2020?

A: Dietrich Stephan, Ph.D. Chairman, CEO, and Founder, NeuBase Therapeutics

The scope of tariffs may impact our industry. The general state of chaos and the impeachment inquiry is absorbing a lot of bandwidth from our legislators, which almost certainly means we will not have major healthcare reform and any associated drug-pricing compression in the next 12 months. This is important to weigh in the context of the election where we already have seen a chilling effect on biotech indices, for example, driven by conversations on driving lower prescription drug prices by Senator (Elizabeth) Warren (D-Mass) and her subsequent ascendance in the polls.

Q: What Will The Global Biopharma Industry Look Like In 2030 And Why?

A: Gaurav Shah, M.D. President and CEO, Rocket Pharma

By 2030, we anticipate the biotech community will be actively pursuing treatments that address the cellular and molecular cause of disease, rather than advancing therapies that merely treat the symptoms. Although we’ve already seen incredible strides over the past two decades in terms of what we are capable of achieving, only three viral vector-based gene therapy products have been approved by the FDA thus far. For perspective, there are between 5,000 and 7,000 rare, genetic diseases that collectively affect up to 10 percent of the global population. This means that significant progress is still required to address 95 percent of the diseases currently lacking an effective therapy. For too long these patients have gone without any treatment options, and it is critical that biotech companies continue to work to address these devastating, life-threatening genetic disorders. As scientists continue to develop increasingly sophisticated molecular tools, we expect that by 2030, we will be better equipped to leverage gene therapy to effectively cure patients with devastating diseases.

Q: What Global Macro Trend(s) Would You Advocate Employees Within Biopharma Pay Particular Attention To In 2020?

A: Arthur Tzianabos, Ph.D. President and CEO, Homology Medicines

Patient-driven drug development will continue to be one of the most important aspects in our industry. The rise of social media fueling the interconnectedness of patients coupled with access to information have allowed for more learning about diseases and potential treatments. Our industry needs to ensure we are listening to the patient community, providing the resources and information they need, and we need to be willing to make changes at any stage of development. For example, we consider endpoints that are not just registrational, but that are impactful for the patient community.

Q: What Country/Region/Biopharma Hub Do You Anticipate Having The Biggest Overall Impact On Biopharma In The Next 10 Years?

A: Gaurav Shah, M.D.

We anticipate that typical biotech hubs such as Boston and San Diego will begin to lose dominance, as a multitude of regions continue to develop worldwide, including areas within the U.S., China, and Europe. China, especially, is poised to become a biotech powerhouse, as the country pours resources into research parks, and government-funded VC firms provide billions of dollars in capital to emerging companies. Ultimately, the hub does not matter nearly as much as the motivation and efforts of companies to find cures for patients and invest their resources, knowledge, and time to therapeutic discovery and development.

A: Arthur Tzianabos, Ph.D.

The Massachusetts biotech hub will have the biggest impact in our industry in the next 10 years. Aside from the obvious strengths of the region, the sheer number of companies working to translate innovative technology into treatments in this area is unmatched. MassBio notes that Massachusetts-headquartered companies have developed therapies that treat up to 2 billion people worldwide. In the next 10 years, this region will continue to bring forward new treatment modalities, including gene editing and gene therapy, RNA interference, and protein regulation, among others, which will continue to drive the field forward.

Sidebar 1

Peter Diamandis Weighs In On The Future Of BioLife Sciences

Perhaps most well-known for founding and serving as executive chairman for the XPRIZE Foundation (1994), Peter Diamandis, M.D., has founded more than 20 companies in the areas of biopharma, longevity, space, VC, and education. He’s also recognized as one of the world’s 50 greatest leaders, so we thought it would be interesting to gain his perspective for biopharma in 2020 and beyond. “Over the next decade, there will be new types of drugs brought to the marketplace by more innovative entrepreneurial players.” He envisions these therapeutics being cellular medicines used for fighting cancers, inflammation, and autoimmune disease. “And though our current FDA regulatory process has not been designed to facilitate their entry, we will see these products enter the marketplace throughout the 2020s.” One of the companies working in this area is Celularity, which he helped cofound and is featured in Life Science Leader’s August 2019 issue.

Diamandis sees AI and ML driving other transformation in biopharma in the late 2020s and early 2030s. “These will identify and design small molecule drugs with high efficiency and efficacy,” he explains. Around the same time, he expects the emergence of quantum computing will affect how we model new molecules and drugs. “The transformation we will see in biopharma will be analogous to what we’ve observed in the entertainment industry where startups and companies outside the industry have emerged as some of the innovators (e.g., Netflix, Amazon, Apple). There’s been a demonetization and a democratization of producing entertainment content, and the same thing will happen in biopharma, especially from young startups in the cellular medicine and AI spaces [e.g., Insilico Medicine]. IBM, Google, and Rigetti Computing are all focused on drug design as one of the high-value disruptions that quantum computing will provide, not in the next couple years, but we’re talking a decade out,” he emphasizes.

Q: What Geographical Area Do You Anticipate Having The Biggest Impact On Biopharma In The Next 10 Years?

A: China’s biopharma industry will go into hyperspeed, driven by the willingness of the government to invest heavily and create research hubs where they can concentrate technology, capital, and minds together. Another driver is the fact that the government is creating regulations that aggressively support experimentation in areas that might be slower to gain regulatory approval in a full democracy.

Q: What Innovation Has The Greatest Potential To Disrupt The Biopharma Industry?

A: The new innovative ways of discovering a drug and putting it through the current FDA-approval model will be disruptive to the industry. Using AI, ML, and quantum computing to design molecules will transform drug development; drugs will come to market faster and with lower costs than in the past while potentially being higher in efficacy. Biopharmas’ need to look at how they connect with the entrepreneurs working in these areas and use their distribution and brands to accelerate new products in a fashion the FDA and the public trusts and appreciates.