When Is Virtual The Right Course Of Action?

By Bob Sheroff, Independent Consultant

The use of virtual supply chains has increased rapidly over the past several years as drug development in biotech startups has flourished. Certainly, in this scenario, the virtual approach makes sense. However, are there other options to consider? Following are three scenarios that may impact the decision of virtual or in-house manufacturing, as well as key aspects to consider in the selection process and in forming a strong relationship between the company and CDMO.

The use of virtual supply chains has increased rapidly over the past several years as drug development in biotech startups has flourished. Certainly, in this scenario, the virtual approach makes sense. However, are there other options to consider? Following are three scenarios that may impact the decision of virtual or in-house manufacturing, as well as key aspects to consider in the selection process and in forming a strong relationship between the company and CDMO.

SCENARIO #1: STARTUP COMPANY WITH NO MARKETED PRODUCTS AND, THEREFORE, NO REVENUE. THE PRODUCT REQUIRES STANDARD TECHNOLOGY.

In this scenario, it makes no sense for a company to tie up capital creating manufacturing capability that already exists. This also alleviates the need to hire a large manufacturing workforce. A small number of seasoned development specialists can work with the CDMO to develop the product through to commercialization. It is also important to recognize in this situation that the development needs are quite broad. Expertise across the entire manufacturing process is required, including API, bulk drug product, packaging, analytical, and distribution. Since many biotech startups focus on precision medicines, the product volumes tend to be smaller, again making a virtual approach a good alternative.

SCENARIO #2: STARTUP COMPANY WITH NO MARKETED PRODUCTS AND, THEREFORE, NO REVENUE. THE PRODUCT REQUIRES “SPECIAL” TECHNOLOGY.

New technology in gene and cell therapy requires specialization that may be difficult to outsource. While CDMO options may be available, the required chain of custody for many of the autologous products adds a significant control factor. If a company needs to track a product from vein to vein, it may be best to do this inhouse. Vein to vein is cell collection from the patient through processing and delivery of the enhanced cells back to the same patient. Companies working in this space may use a combination of CDMO and in-house production. Many companies use a CDMO approach for production of the viral vectors that will be used to alter the collected patient cells.

SCENARIO #3: ESTABLISHED COMPANY WITH REVENUE. THE PRODUCT REQUIRES STANDARD OR SPECIALIZED TECHNOLOGY.

There is a lot to be said for controlling your own destiny. Companies that have capacity are best-served by using what they have. A CDMO approach could be used to ensure uninterrupted supply, splitting the production requirements between the in-house capability and the CDMO. For a large pharma company, it may make sense to go virtual for a smaller precision product, depending on available equipment sizes and how disruptive production of the smaller product may be to the overall large pharma supply chain.

OTHER CONSIDERATIONS

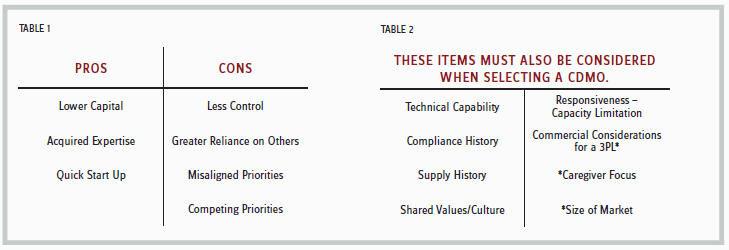

Many factors go into deciding where to develop and manufacture a product. The above scenarios simply provide broad guidelines. Considering the pros and cons of an outsourced model depicted in Table 1, the pros are quite evident — cost avoidance and speed. The cons are more difficult to assess but can have grave consequences when launching a new product. Compliance issues that arise at the CDMO can have a dramatic impact on the supply of your product. You are fully reliant on the CDMO to provide sustained compliance. While you may be intimately involved in what is occurring around your product, you do not know what is happening with other products or areas of the CDMO. In this case, what you don’t know can kill you. Unfortunately, priorities can change at a CDMO, which can negatively impact their performance. For instance, perhaps the CDMO is launching its own products and has less focus on the contract business. If your product is more successful than anticipated, you may need additional line time at the CDMO. However, it may not be available depending on line time committed to other customers of the CDMO.

The FDA has clearly stated that it views contract manufacturers as extensions of the company that markets the product. The marketing company must stay intimately connected to what is occurring at its CDMOs. This requires regular meetings with the CDMOs to assess their performance and address any quality or compliance issues they are encountering. Developing a set of metrics is a good way to quickly focus the review. One quick measurement of a CDMO is how long it takes to close an investigation — a prolonged investigation may indicate lack of resources or technical prowess, both of which are indicative of an inherent weakness.

Technical capability is straightforward. It is important to look at the compliance history from the vantage point of what the past issues were and how they were addressed. Knowing the history before the company does a quality audit of the CDMO is important. Supply history should focus on times when the CDMO was unable to meet the requested demand, but this should also consider the accuracy of the forecast provided by the marketing company. The challenges of forecasting a new product’s demand have been well-documented. Responsiveness is the CDMO’s ability to adapt to the forecast volatility of any new product. Finally, when looking at selecting a 3PL, the caregiver focus and size of market are key. For instance, if a product is in oncology, there are 3PLs with a strong presence in this area. Also, if the product is relatively small, a single 3PL may suffice to cover the entire U.S. supply.

NEGOTIATE AGREEMENTS IN PERSON

CDMO selection should not be taken lightly. Once you choose a CDMO, there is still the matter of the agreements necessary for both development and commercialization. The commercial agreement, or master service agreement (MSA), is more complex, considering a longer time period and the commercial complexities of supply. When negotiating an agreement, nothing beats face-to-face interaction. Sending red-lined agreement revisions back and forth will get you so far, but having face-to-face meetings speeds things along. Negotiating the MSA provides an excellent opportunity to assess the alignment of the two companies. The MSA should consider the actions when something does not go as expected, and it should also delineate the process to resolve any disagreements. A CDMO relationship, like any good relationship, must be built on trust and open, transparent communications.

All too often development agreements fail to address some of the larger items that dominate commercial agreements. In some situations, companies that have successfully completed developmental work encounter disagreements when negotiating a commercial agreement. While you want to avoid overburdening the development agreement, it is still important to discuss some aspects of the commercial agreement — like failure to supply provisions and forecast changes — early on to ensure the companies see a unified path forward.

Finally, given the recent consolidation within the CDMO and CRO space, companies have the advantage of selecting a one-stop option for product development, clinical supply, and commercialization. This provides a great opportunity for companies going the virtual route to significantly speed their product to market.