When Will The Biotech Sky Fall?

By Rob Wright, Chief Editor, Life Science Leader

Follow Me On Twitter @RfwrightLSL

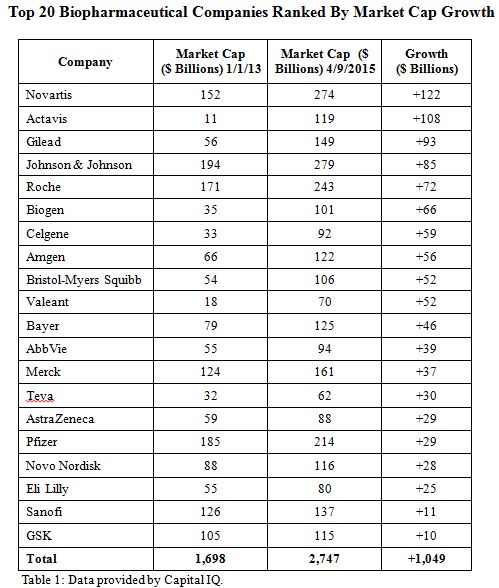

If you lived through the dot-com stock market crash of March 11, 2000, you probably have some appreciation for the present day Henny Pennys who fear the sky will soon fall for biotech. One of the key trends fueling the alarm is the continued surge in biopharmaceutical company valuations. For example, over the past two years the top 20 biopharmaceutical companies (as measured by market cap) grew by more than $1 trillion (table 1).

In addition, the NASDAQ Biotech index has been up over 240 percent since the beginning of 2012, dwarfing the 82 percent gain logged by the NASDAQ 100 tech index. Surely, these factors are a clear indication that the biotech sky is destined to soon fall.

But, I beg to differ.

Because unlike the dot-com era where investors desired big ideas over detailed business plans, the current biopharma surge is being driven by strong performance and multiple expansion (i.e., when earnings growth accelerates, investors “pay up" for higher future cash flows).

Gauging A Company’s Fiscal Fitness

Many investors utilize net income as a barometer for determining a company’s health. However, a better metric to use is operating cash flow because cash flow is harder to manipulate under GAAP (generally accepted accounting principles) — and because a company that does not generate cash long term is essentially on its death bed. But don’t just look at a company’s operating cash flow in a vacuum. Instead, an important ratio to consider is quality of earnings (QE), which is calculated by dividing a company’s operating cash flow by net income. A QE above “1” is indicative of a firm having a strong ability to fund its activities. As you can see in table 2, 18 of the top 20 biopharma’s have a QE greater than or equal to 1. So why would we think those companies are on the brink of failure?

Are Biopharma’s Price To Earnings A Bit Out Of Whack?

Of course there are other metrics soothsayers point to that predict the fall of biotech. Take trailing P/E (i.e., past performance) for example. Table 3 shows a ranking of the top 20 biopharmaceutical companies based on trailing P/E. As you can see, 19 of the top 20 are currently outperforming what analysts think will happen in the near future, the only exception being Merck. Are current P/Es out of whack? Perhaps. But given the DJIA continues to trade in the 18K range, the current P/Es aren’t, in my humble opinion, extremely and unjustifiably, out of line.

Furrther, if you review the P/E ratios by industry, it seems biotech has already had a bit of a correction. The current P/E for Biotech is 50.21, which is four times lower than the trailing P/E of 223.02. With regard to the pharmaceutical industry, the current P/E is 113.63, versus the trailing P/E of 49.13. This might indicate that if there is a correction to be felt, perhaps it will be more in pharma than biotech (table 4). .However, if you combine the two industries, the current P/E is still below the trailing, and the forward P/E and growth projections are very similar.

But what I find most interesting is the fact that if you went back in time to Sept. 1, 2008 and created a list of profitable biopharmaceutical companies with market caps between $1 billion and $30 billion, you would find there were 68 companies. Today, you would find only 28 of these companies still remaining thanks to M&A. In fact, 15 of those companies went away in just the past 15 months. Since 2010, investors have been rewarding the acquiring companies with higher stock prices post acquisition. This wasn’t always the case. For example, from 2001 to 2009, on the day following acquisition, stock prices of the acquiring company went down in six out of the nine years.

The Magic Eight Ball Says

What does all this mean for the future of biopharma? In my opinion, I believe M&A activity will continue for several more quarters, however, not perhaps at the same volume. There will be a greater focus on top-line growth. In addition, R&D will regain prominence. Finally, while some believe biotech will come down off its highs, keep your eye on pharma instead. Expect the impact of correction to be lessened as traditional Big Pharmas buy up biotechs to strengthen their pipelines, moving us ever closer to the eventual singularity of biopharma. Be sure to read my next blog where I will expand on the merging of the pharmaceutical and biotech industries into one — biopharma.