Why So Many Biotech Launches Miss Expectations, And How To Fix It

By Bennett Smith

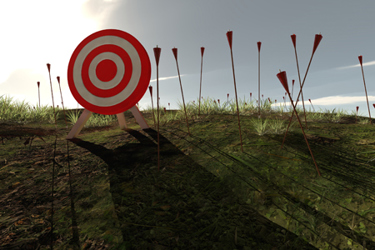

Biotechnology is all about scientific breakthroughs that lead to transformative therapies. But despite billions invested and years of R&D, data from Deloitte found that more than half of drug launches miss expectations—which the study defined as generating less than 80% of expected sales.

It’s a staggering figure that suggests we are either terrible forecasters, not great at execution, or a combination of both. And here’s what I find most interesting: The reasons for the underperformance are rarely about the science itself, which everyone assumes is the more challenging piece of the equation. There's also a common misconception that once the science is established, business development — including deals, M&A, and commercialization — will effortlessly follow.

The Most Common Pitfalls

Instead, the most common pitfalls involve missteps in market access strategy and a fundamental misunderstanding of market dynamics. As someone who has witnessed both the triumphs and the disappointments of biotech commercialization, I believe the solution lies in integrating commercial strategy much earlier in the R&D process. The call for earlier commercial strategy isn't novel, but getting it right requires some nuance and, above all, leadership discipline.

The overarching goal for companies is to gain the clearest possible understanding of whether the scientific breakthrough will receive an approved label that provides sufficient clinical value to justify payer reimbursement, compel providers to prescribe, and gain patient acceptance. Many companies, even when addressing unmet market needs with robust primary research, still misjudge how the industry’s tendency toward slow evolution in behavior change will impact their drug. They also sometimes miss opportunities that could pave the way for a successful, albeit more gradual adoption of their product.

A notable example of failing to incorporate market realities into the commercial planning is the cell-and-gene-therapy space. While it has seen some commercial successes, that sector has become nearly uninvestable, partly because sickle-cell gene-therapy companies have overlooked patients' preference for existing standards of care over a five-month curative process.

A counter-example would be Argenx, and its launch of Vyvgart in the U.S. with a hyper-segmented approach. It was the company’s first commercial drug in the U.S., and the market was competitive. Management made clear to investors and analysts from the outset that the initial target was patients who required more aggressive treatment. That sharp focus allowed the drug to consistently beat analyst expectations, and because of that, the company was able to enter other non-U.S. markets in quick succession.

Life sciences companies tend to anchor their launch strategies on financial models (and overly optimistic market size projections) created five to 10 years before commercialization. When their products fail to distinguish themselves in pivotal trials, the value proposition erodes, and payers become reluctant to reimburse at the desired price point. The gap between the target product profile and actual clinical data is a recurring source of launch underperformance.

Biogen launched Aduhelm, the first Alzheimer’s drug approved in 18 years, based on a surrogate endpoint rather than clear clinical efficacy. It was the absence of clarity around the efficacy for patients that led to payer resistance. Aduhelm is no longer a priority for Biogen.

One company that pivoted to avoid this pitfall: Sage Therapeutics was optimistic that they would get both Major Depressive Disorder and Premenstrual Dysphoric Disorder indications for their drug Zurzuvae. However, based on early regulatory feedback, they wisely adjusted their go-to-market strategy to focus on PMDD alone. Sage, which was recently acquired by Supernus, is still selling the PMDD drug.

For their part, CEOs are sometimes reluctant to make necessary mid-course updates to forecasts — for fear they’ll then have to relinquish some control and the new stakeholders will gain influence over the early research and clinical development. Sometimes, underlying this entire dynamic is the founders’ desire for an early exit, rather than committing to building a fully integrated company. They shy away from the latter because it often means bringing on a new leadership team.

Another factor: The competitive landscape can change dramatically during the long journey from discovery to launch. Predicting which competitors will reach the market — and with what data — is a significant challenge. Large companies invest in head-to-head trials to ensure differentiation, but smaller biotechs may find themselves unexpectedly crowded out.

For commercial teams, all of this is compounded by the fact that payers have evolved over the past decade. They now leverage better data analytics and exercise stronger control over what goes on the formulary. Products that might have succeeded on brand reputation alone a decade ago now face more rigorous value assessments.

Big pharma, with their portfolio of drugs, can easily absorb a failed launch. But single-product biotechs don’t have that luxury; they can face existential risk when their only product underperforms.

Strategies That Can Help

So how can biopharma companies avoid these traps?

Rather than focusing solely on clinical efficacy, leading biotech companies are now designing clinical trials that capture a broader set of outcomes, including quality-of-life improvements, reductions in caregiver burden, and other real-world impact that matters to payers and patients alike.

It's also important to engage with payers well before a product reaches the market. Soliciting feedback during the trial design phase allows companies to tailor their evidence generation to address the specific requirements and concerns of the reimbursement decision-makers. A flexible launch strategy is important, too: rather than building large commercial teams based on optimistic projections, a scaled approach, to coincide with hitting revenue milestones, makes more sense.

Translating scientific innovation into commercial success is not just about having the best molecule — it’s about understanding and adapting to the realities of the market. By integrating commercial strategy into R&D earlier in the planning process, collecting robust market access evidence, and remaining agile in the face of competitive and payer dynamics, biotech companies can dramatically improve their odds of launch success.

About The Author:

Bennett Smith is SVP of Commercial at a California-based biotech startup operating in stealth mode. He has over 20 years of experience launching blockbuster brands and revitalizing mature products at companies including Orchard Therapeutics, Akebia Therapeutics, Regeneron, and Novo Nordisk.

Bennett Smith is SVP of Commercial at a California-based biotech startup operating in stealth mode. He has over 20 years of experience launching blockbuster brands and revitalizing mature products at companies including Orchard Therapeutics, Akebia Therapeutics, Regeneron, and Novo Nordisk.