Congress Scrutinizes Rx Pricing As Administration Releases Proposal To Ban Rebates

By John McManus, The McManus Group

After temporarily resolving the partial government shutdown, Congress kicked off the 116th Congress with two separate congressional hearings focused on pharmaceutical pricing. Despite mounting evidence that pharmaceutical costs have flattened recently, the pharmaceutical industry took licks from members on both side of the aisle in the divided Congress.

After temporarily resolving the partial government shutdown, Congress kicked off the 116th Congress with two separate congressional hearings focused on pharmaceutical pricing. Despite mounting evidence that pharmaceutical costs have flattened recently, the pharmaceutical industry took licks from members on both side of the aisle in the divided Congress.

In hearings on Jan. 29, the Senate Finance Committee and House Government Reform & Oversight Committees stacked witnesses hostile to the industry, and even usually market-oriented conservative members felt little compunction to defend the industry that is now the subject of populist ire.

Finance Committee Chairman Grassley (R-IA) and ranking member Ron Wyden (D-OR) expressed frustration for pharmaceutical companies’ refusal to testify and intimated that they may be called in future hearings. Senator John Cornyn (R-TX) questioned price growth of products that have been on the market for years and have long since recouped their R&D expenses.

Rep. Elijah Cummings (D-MD), chairman of government reform & oversight, incredibly indicated that investigations on drug pricing are a greater priority than oversight of the Trump administration. He said, “Immediate action is needed on drug prices,” and referenced the letters the committee had sent 12 pharmaceutical companies soliciting information on why they are increasing drug prices and how they are using the proceeds.

Diabetic patients dependent on insulin were featured at both hearings, in part due to a Washington Post investigation, which noted that the insulins manufactured by the three major companies had grown tenfold in recent years.

Kathy Sego, a volunteer for the American Diabetes Association, testified at the finance committee that her son, a Type 1 diabetic, had taken only one-fourth of the insulin prescribed for him because their family could not afford the $1,700 monthly cost. Rationing insulin led him to limit his food intake and lose an unhealthy amount of weight. While they had resolved the health issue, she wondered why the price had grown so much for a product that had not fundamentally changed in 20 years.

List prices of the three major companies manufacturing insulin seem to rise in lockstep even while net prices remain flat, because manufacturers must finance ever higher rebates that pharmacy benefit managers (PBMs) demand in order to maintain formulary access to their patients.

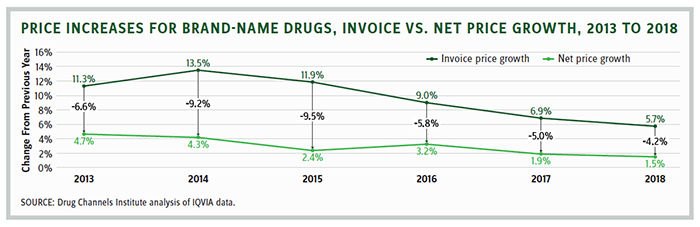

Rising list prices offset by retrospective rebates is a pricing scheme that is not limited to insulin. It is the primary method for manufacturer negotiation with PBMs and, by extension, all privately and Medicare-insured patients. In 2018, net prices grew only 1.5 percent, according to a report from the IQVIA Institute for Human Data Science. Leerink Partners’ analysis showed that net price growth in the U.S. slowed from 6 percent in 2016 to 2 percent in 2018. Moreover, Novartis, Pfizer, Allergan, Sanofi, and other companies predict substantial rebates will offset list price increases this year.

But neither patients nor politicians seem to care that pharmaceutical costs have leveled. They’re focused on what the patient pays at the pharmacy counter. Patients enrolled in plans with high deductibles feel like they are being gouged because they do not benefit from back-end rebates paid to plans. Similarly, Medicare patients pay list prices in their deductibles and coinsurance based on list prices in Medicare Part D.

This explains why the Medicare Payment Commission (MedPAC) analysis, released just a week before the hearings, stating that Medicare Part D pharmaceutical spending had actually declined slightly from 2016 to 2017 and that monthly beneficiary premiums had remained stable at about $30 since 2007, had zero political impact.

Trump Administration Releases Bold Rule to Prohibit Rebates

Recognizing this convoluted pricing structure must be solved by bold action, the Trump administration released a comprehensive — and highly anticipated — proposed rule on Jan. 31 that would repeal the safe harbor protection manufacturer rebates that had been provided from the antikickback statute.

Health and Human Services Secretary Azar’s release argued that, “This proposal has the potential to be the most sweeping change to how Americans’ drugs are priced at the pharmacy counter, ever, by delivering discounts directly to patients at the pharmacy counter and bringing much-needed transparency to a broken system.”

The proposed rule, slated to go into effect in January 2020, also would establish two new safe harbors to replace the old one:

- Point-of-Sale Reductions in Price for Prescription Pharmaceutical Products. These reductions must be: set in writing, provided at full value to the dispensing pharmacy through a chargeback or a series of chargebacks, defined accordingly, and reflected in full in the price the pharmacy charges the beneficiary at point of sale.

- PBM Service Fees. New safe harbor established for flat service fees provided in written agreements that specify remunerations made for services that benefit the manufacturer, while related in some way to the PBM’s arrangements for services to health plans. Fees must be consistent with fair-market value, fixed, and not based on sales percentages or other metrics of volume or business transactions.

HHS is soliciting comments on the gamut of variables, including beneficiary out-of-pocket spending, manufacturers’ settings of list prices, commercial markets, changes to formulary placements, possible effects on pricing or competition that could result from an increase in transparency, issues pertaining to PBM-plan integration, and impact to beneficiary adherence.

HHS also invites comment on whether the proposal should be delayed until 2021, or whether a more modest approach (proposed last year), which would require a portion of rebates to be provided at point of sale, should be pursued.

The coming weeks will be a bonanza for actuarial firms, helping stakeholders on all sides of the pharmaceutical distribution chain better understand the complicated and highly interactive ramifications of the proposed overhaul of a pricing methodology that has become ingrained. Out-of-pocket expenses, particularly for those with high costs, will certainly decline. But premiums are expected to increase because the retrospective rebates were used to keep them stable. Projections may be highly uncertain and very dependent on what behavioral changes are assumed to result from a substantially changed incentive structure.

Add this proposed overhaul to the raft of significant proposals the Trump administration has released to tie Medicare Part B drugs to a foreign price index and provide plans with more tools to limit patient access and gain more leverage on manufacturers in Part D.

Complicating matters further are the intense politics of the issue, with the Trump administration fighting Democrats for getting credit for reducing drug costs, because many believe this issue will largely determine the critical senior vote in the 2020 election.

John McManus is president and founder of The McManus Group, a consulting firm specializing in strategic policy and political counsel and advocacy for healthcare clients with issues before Congress and the administration. Prior to founding his firm, McManus served Chairman Bill Thomas as the staff director of the Ways and Means Health Subcommittee, where he led the policy development, negotiations, and drafting of the Medicare Prescription Drug, Improvement and Modernization Act of 2003. Before working for Chairman Thomas, McManus worked for Eli Lilly & Company as a senior associate and for the Maryland House of Delegates as a research analyst. He earned his Master of Public Policy from Duke University and Bachelor of Arts from Washington and Lee University.