"Surprise Medical Bills" May Displace Rx Drugs As Healthcare Focus In 2020

By John McManus, president and founder, The McManus Group

The same politics that fuel patient ire at the drug industry for rising out-of-pocket costs manifest in the other major focus of health legislation this year: “surprise medical bills,” which occur when a patient receives care from an out-of-network healthcare provider.

The same politics that fuel patient ire at the drug industry for rising out-of-pocket costs manifest in the other major focus of health legislation this year: “surprise medical bills,” which occur when a patient receives care from an out-of-network healthcare provider.

There is bipartisan consensus that patients should be protected by limiting their copayments for out-of-network providers to the in-network rate. But how those out-of-network providers get paid for that care remains the point of contention.

The battle pits healthcare providers, including doctors, hospitals, and freestanding emergency centers, against the insurance industry. Healthcare providers argue that many insurers overly restrict their networks and demand deflated prices that are unacceptable, resulting in more out-of-network providers and medical bills that are not covered. Insurers counter that some provider practices deliberately call in out-of-network doctors during procedures, particularly emergency care and surgery, to bill at excessive out-of-network rates.

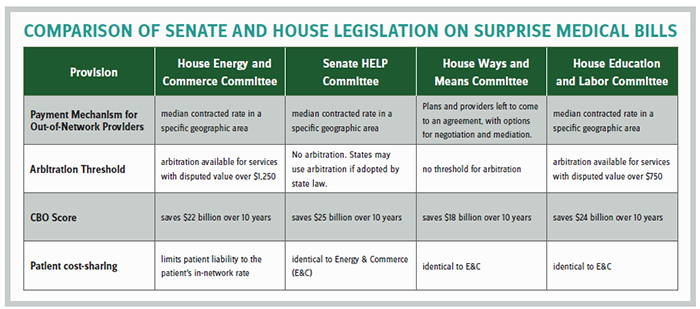

Last year, the House Energy & Commerce and Senate HELP committees reported bipartisan legislation addressing the issue. Under the HELP Committee bill, insurers would pay out-of-network providers based on the median in-network rate while the Energy & Commerce bill would also rely on the median payment but provide for binding arbitration for cases over $1,250. Providers prefer arbitration because they would otherwise be stuck in a downward spiral of ever-lower median rates that depress their payments and reduce their leverage with insurers by staying out-of-network.

The two committees appeared close to a bicameral, bipartisan agreement in December, but that effort was scuttled by Minority Leader Chuck Schumer (D-NY) (at the behest of the New York hospitals), as two other House committees also objected that a deal was premature because they had not yet weighed in. The tentative agreement would have established a $750 threshold for arbitration, making it more provider-friendly than either original bill.

Relevance to Rx Industry?

Surprise billing legislation is of relevance to the pharmaceutical industry because the omnibus funding bill enacted by Congress in December extended popular Medicare and Medicaid health provisions through May 22, 2020. This means another extension of those expiring provisions must be enacted before Memorial Day and financed by other health legislation – prescription drug pricing reform and/or surprise billing. A bill that produces robust savings on surprise billing relieves pressure on Congress to come to an agreement on prescription drug pricing reform.

Surprise billing reform can be the offset rather than cost controls to pharmaceuticals.

A few weeks ago, the Ways & Means Committee unanimously reported its version of surprise billing legislation with strong support of the provider community because the bill called for arbitration with no dollar threshold — meaning any claim can go to arbitration. Importantly, the Congressional Budget Office projects the bill will save the federal government $18 billion over 10 years due to lower employer health costs, which allow for more taxable wages and profits. That savings number is substantial and only modestly less than the more insurance-friendly versions. The committee appears to have threaded the needle on a package that both solves a vexing health policy issue for patients and simultaneously produces revenue to finance other pressing health matters.

Moreover, since the insurance industry was seen as a big winner in the 2019 omnibus legislation, where Congress repealed both the health insurance tax and the “Cadillac” tax on high-cost health plans (two financing mechanisms for Obamacare), Congress is likely to be less sympathetic to the insurance industry views on a more provider-friendly version of the legislation that still produces substantial savings.

It is unclear how the House will meld the three bills from its committees of jurisdiction, but floor action is likely in March with a bill similar to Ways & Means.

Senate Focus Remains on Prescription Drugs

Meanwhile, Senate Finance Committee Chairman Chuck Grassley (R-IA) is trying to build support for his Grassley-Wyden drug bill, reported out last summer with mostly Democrat support. Majority Leader McConnell (R-KY) has refused to give it floor time because a majority of his caucus, including nine of 15 finance Republicans, oppose the bill.

Chairman Grassley has said he is working on corralling 25 Republicans on a modified bill to show McConnell he has sufficient caucus support, and he has solicited Health and Human Services (HHS) Secretary Alex Azar to help make the pitch. At a February hearing before the Senate Finance Committee, Azar stated, “There would be no material impact in any way to the R&D enterprise of the United States,” from the Grassley-Wyden bill.

The critical point of contention in the Republican caucus remains the inflation penalties demanded by Ranking Member Ron Wyden (D-OR) and included in the bill, which require manufacturers to pay rebates to Medicare for any price increase above the consumer price index.

Grassley said, “We are saving the taxpayer money. Isn’t that a conservative goal?” He argues that these are not price controls, but rather caps on “subsidies” for Part D.

Meanwhile, Senators Mike Crapo (R-ID), Mike Enzi (R-WY), and Richard Burr (R-NC) introduced competing legislation, largely based on the House Republican alternative to the Pelosi bill. That bill excludes the inflation rebate penalties, but even more importantly, reduces and smooths the discounts required of manufacturers in portions of the Part D benefit. While the modified Grassley bill would require a 14 percent price discount for the most expensive drugs, and just 7 percent in the initial benefit, the Crapo bill calls for a uniform 10 percent discount throughout the entire benefit. Such a difference results in thousands of dollars in manufacturer liability for high-cost drugs for diseases such as AIDS, MS, and cancer.

But even if Senate Republicans can get consensus and move a prescription drug bill to floor consideration, it is unclear how that bill can be merged with the radical Pelosi bill that would cap prices of many drugs at an international index and empower the Secretary to negotiate for even more aggressive discounts. And will Speaker Pelosi hand President Trump a win on this pivotal issue for the seniors’ vote months before the election?

Much more likely is a deal on surprise medical bills, perhaps married with consensus and small-ball prescription drug issues such as price transparency. Such a package could pass Congress in May and then leave the bigger issues on pharmaceutical pricing reform to be decided in 2021 by a new Congress and a re-elected or new president.

John McManus is president and founder of The McManus Group, a consulting firm specializing in strategic policy and political counsel and advocacy for healthcare clients with issues before Congress and the administration. Prior to founding his firm, McManus served Chairman Bill Thomas as the staff director of the Ways and Means Health Subcommittee, where he led the policy development, negotiations, and drafting of the Medicare Prescription Drug, Improvement and Modernization Act of 2003. Before working for Chairman Thomas, McManus worked for Eli Lilly & Company as a senior associate and for the Maryland House of Delegates as a research analyst. He earned his Master of Public Policy from Duke University and Bachelor of Arts from Washington and Lee University.