Told You So! Repeal Of Individual Mandate Penalty Has No Impact

By John McManus, The McManus Group

When Congress enacted President Trump’s tax cut package in December 2017, it eliminated the tax on individuals who had failed to obtain health insurance (aka, the individual mandate penalty), and the Washington establishment predicted that provision would result in massive premium hikes and millions of more uninsured. The theory was that healthy and young people would cancel their insurance policies without the penalty.

When Congress enacted President Trump’s tax cut package in December 2017, it eliminated the tax on individuals who had failed to obtain health insurance (aka, the individual mandate penalty), and the Washington establishment predicted that provision would result in massive premium hikes and millions of more uninsured. The theory was that healthy and young people would cancel their insurance policies without the penalty.

Indeed, the Congressional Budget Office (CBO) projected 13 million more uninsured including five million Medicaid enrollees in 2018. In my February 2018 column, I ridiculed this assumption, pointing out that no poor person would quit free healthcare due to an absence of a tax that never applied to them in the first place (because they are too poor to pay taxes).

In May, CBO updated its baseline — noting that the identical 50 million people would continue to be covered by the Medicaid expansion in 2018 as had enrolled in Medicaid in 2017. Whoops!

Moreover, the latest statistics from the CDC show that the uninsured rate actually declined — from 29.3 million (9.1 percent) in 2017 to 28.3 million people (8.8 percent) in 2018.

Similar hyperbole on the impact to healthcare premiums also has failed to materialize. A coalition of healthcare provider and health plans, including the American Medical Association and America’s Health Insurance Plans, predicted calamity if the mandate tax was repealed, stating: “There will be serious consequences if Congress simply repeals the mandate while leaving the insurance reforms in place: Millions more will be uninsured or face higher premiums, challenging their ability to access the care they need.”

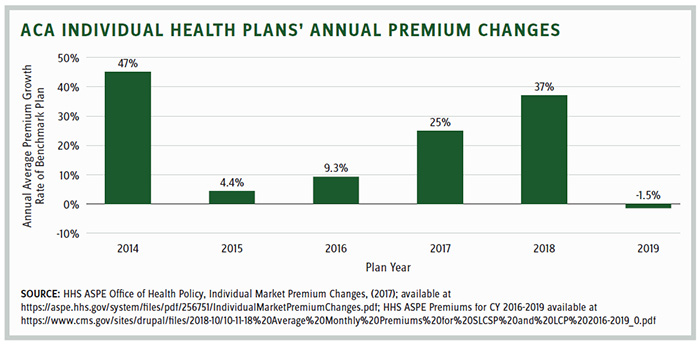

A couple of weeks ago, the Center for Medicare and Medicaid Services (CMS) announced that premiums for the benchmark plan Healthcare.gov (the second-lowest “silver” plan) will actually decline in 2019. This is the first time since enactment of the ACA that premiums will drop, and CMS said the decline will be about 1.5 percent nationally but much greater in certain states.

Under the Obama administration, premiums for individuals more than doubled from $2,784 in 2014 to $5,712 in 2017. Premiums increased another 37 percent between 2017 and 2018 — before repeal of the individual mandate tax.

CMS Administrator Seema Verma declared, “Despite predictions that our actions would increase rates and destabilize markets, the opposite has happened.”

How could the conventional wisdom be so wrong?

The health policy community is actually a very small, tight-knit, Washington-centered group of individuals in senior government, think tank, and interest group positions. They are generally left-leaning and highly susceptible to groupthink that favors conformity over dispassionate, quantitative analysis.

Any reasonable analysis would not predict 13 million people would cancel their heavily subsidized policies — by government and their employers — simply because an inconsequential penalty tax ($695 for most individuals) was repealed. The costs of doing so clearly outweigh the benefits, and people generally do not act contrary to their own self-interest.

Now that we’ve seen the mandate tax repeal has neither worsened coverage nor premiums, it is notable that it’s no longer a Democratic talking point heading into the midterms. Democrats have pivoted to claiming that Republicans are trying to repeal pre-existing condition protections.

But these assertions are as baseless as the predictions of market calamity that would result from the mandate tax repeal. The Washington Post — no friend of the GOP — gave the Democratic Congressional Campaign Committee “four Pinocchios” for its disingenuous ads attacking Rep. Brian Fitzpatrick (R-PA), Rep. Dave Brat (R-VA), and other Republicans for voting against protecting people with pre-existing conditions. Procedural votes were conflated into votes on policy and votes on policy ignored actual legislative language in the bill.

State Litigation Threatens the ACA

But there lies a real threat to the ACA’s insurance mandates and pre-existing condition protections, and it is not in the Congress but in a lawsuit brought by Texas and 19 other Republican-led attorneys general. They argue that the ACA’s individual mandate is unconstitutional since the Republican tax cut law eliminated the associated penalty for those without insurance, and that tax was the reason Chief Justice Roberts cited that the law is constitutional in its landmark decision National Federation of Independent Businesses v. Sebelius.

In September, the Northern District of Texas held a hearing where the plaintiffs argued that the individual mandate penalty cannot be severed from the rest of the ACA. If the mandate is repealed, then the whole law should fall, including insurance-related mandates and other provisions of the law such as closing the coverage gap in Medicare Part D. Under this reasoning, a law may be made unconstitutional by the enactment of a subsequent law by a different Congress with a different intent than the one that enacted it. That seems a stretch, as Congress explicitly eliminated the penalty tax and left the rest of ACA intact.

The Department of Justice concurred with the plaintiffs that some, not all, of the ACA should be struck down. The law is being defended by 16 attorneys general from Democratic states and almost the entire healthcare provider community filed amicus briefs to uphold the law.

In a concurrent lawsuit, Maryland sued the Trump administration for undermining the ACA and taking the position in Texas v. United States that major components of the ACA should be invalidated. Maryland argued that the uncertainty caused by the Trump administration is harming Maryland, and that the repeal of the individual mandate tax is unconstitutional. Maryland asserts that the Trump administration is violating the Constitution’s “Take Care Clause” by attempting to nullify ACA through executive action.

The dueling lawsuits could trigger an injunction in both or either case that may be stayed and eventually appealed and headed to the Supreme Court for

final adjudication.

Newly appointed Justice Kavanaugh would be among the justices to decide the outcome of these cases. If the Supreme Court knocks down all or part of the ACA, a bitterly divided Congress will have to develop consensus on which items, if any, it can address and resolve.

John McManus is president and founder of The McManus Group, a consulting firm specializing in strategic policy and political counsel and advocacy for healthcare clients with issues before Congress and the administration. Prior to founding his firm, McManus served Chairman Bill Thomas as the staff director of the Ways and Means Health Subcommittee, where he led the policy development, negotiations, and drafting of the Medicare Prescription Drug, Improvement and Modernization Act of 2003. Before working for Chairman Thomas, McManus worked for Eli Lilly & Company as a senior associate and for the Maryland House of Delegates as a research analyst. He earned his Master of Public Policy from Duke University and Bachelor of Arts from Washington and Lee University.