An Updated View Of The Federal Segment: Access Levers For Manufacturers

By Susan Pugh, Shannon Matwiyoff, and Cheryl Middleton

This article is the third and final installment of a three-part series aimed at helping drug and device manufacturers better navigate the VA and DoD health systems. Click here to read part one of the series - Veterans Affairs Formulary Management and part two of the series – DHA Formulary Management.

This final installment in the series shifts from process to practice, spotlighting access levers that truly shape uptake in VA and DoD. For manufacturers, knowing what to pull and when can mean the difference between stalled efforts and sustained traction. Before diving into the levers, it is important to center thinking around the nature of the federal marketplace. Unlike commercial accounts, VA and DoD health systems are mission-driven, budget-controlled, and governed by processes that prioritize equity and stewardship of taxpayer dollars over commercial incentives. Success is rarely immediate. It requires alignment with agency priorities, patience with pushback, and a readiness to adapt strategies as policy or leadership changes occur. This reality underscores why a tailored approach — rather than a recycled commercial hospital model — is critical.

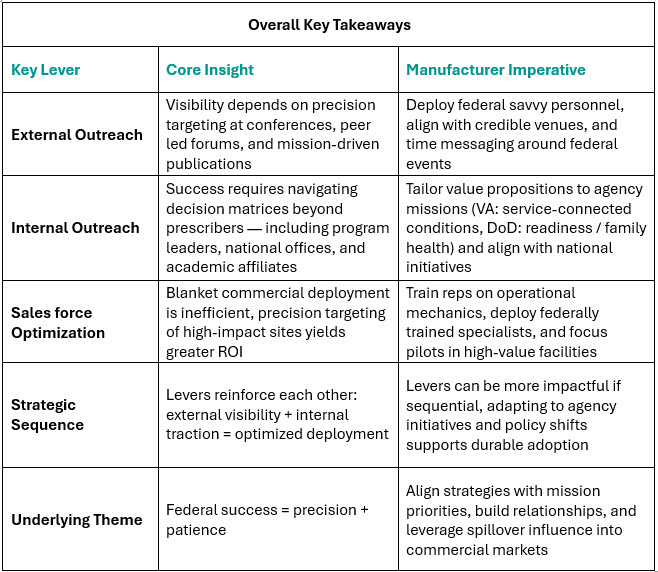

We start with external outreach, the most visible lever and often the first step in building credibility with federal stakeholders. From there, the focus shifts inward to national offices, program leaders, and academic affiliates, where internal outreach determines whether early interest can be converted into tangible access. Finally, we examine sales force optimization: where manufacturers must recalibrate deployment models for precision and efficiency in a resource-intensive setting. Taken together, these levers form a sequence, each one reinforcing the next, creating a structured pathway to federal market success.

Lever 1: External Outreach – Building Visibility Where It Matters

External outreach remains one of the most misunderstood areas of federal engagement. In the federal market, generalized marketing efforts yield little return. Success depends on precision: targeted, data-driven engagement that aligns with federal missions. Conferences that are targeted to Federal health systems, co-sponsored by Federal agencies, or promote speakers that are current Federal decision makers are not just trade-show moments, they are working forums where relationships and credibility are built.

High-value engagement requires deploying the right personnel, including medical affairs experts and federal-savvy account managers who can interact directly with PBM pharmacists, therapeutic leads, and policy influencers. For instance, at AVAHO, national oncology leaders like Dr. Matthew Rettig of VA West LA often set the tone for system-wide oncology adoption, making presence and dialogue at such events invaluable.

Federal clinicians are not swayed by promotional detail or short-term discounting; they respond more to credible peer insights. Positioning subject matter experts on panels, discussion forums, or CME-linked programming builds trust. This provides opportunity for manufacturers to educate, create dialogue, and open doors for subsequent site-level discussions. Similarly, mission-centric publications carry far more weight than commercial journals. Content on case studies or articles framed around readiness, patient safety, and cost-effectiveness resonate deeply in these trusted outlets.

Advertisements can be effective in these publications when they are focused and reinforce how a therapy supports veterans or service-members. Timing of advertisement placement also helps, particularly around a market event such as a label expansion or competitor coverage disruption. Well-prepared manufacturers can seize the opportunity to speak directly to the Federal market and position themselves as a meaningful option.

Lever 2: Internal Outreach – Navigating System Decision Pathways

Once baseline visibility and awareness are established, internal outreach across each health system becomes the next critical lever. A frequent misstep is neglecting to use data to uncover the less obvious links between prescribing patterns and provider location. For instance, a patient’s local VA hospital may lack an on-site specialist. Rather than referring the patient to community care, the local VA hospital might connect them with the appropriate specialist at another VA facility, while the prescriptions or infusions occur through the patient’s local site. Understanding these high-control IDN dynamics is essential for efficient resource deployment. This example illustrates how a sales representative’s traditional call point may not align with actual VA utilization data, underscoring the need for a more complete understanding of how this market functions and nuanced targeting strategies.

Another critical misstep is limiting engagement to individual prescribers. True traction within federal health systems requires navigating a matrix of decision makers and an understanding of who influences policy and practice. Program leaders and national offices carry disproportionate influence. Engagement with them must frame products as solutions aligned with overarching agency missions. For example, positioning a supportive care therapy as an “acute patient safety” intervention tied to reducing ER visits or opioid use directly aligns with VA’s national priorities on pain management and continuity of care.

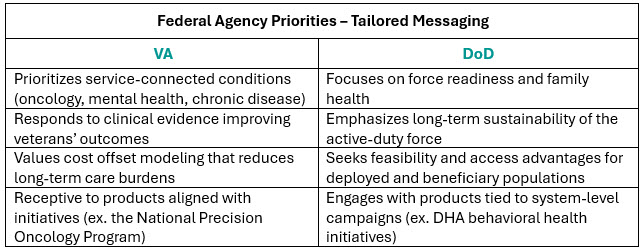

Each agency emphasizes different burdens, and tailoring messages accordingly is essential. VA prioritizes service-connected conditions such as oncology, mental health, and chronic disease management; while DoD focuses heavily on readiness, family health, and long-term sustainability of force. Products that can connect with these themes, through clinical evidence, cost-offset modeling, and access feasibility, stand out in crowded therapeutic categories. Moreover, federal agencies frequently launch targeted initiatives, such as VA’s National Precision Oncology Program or DHA’s behavioral health campaigns. Products aligned with these initiatives not only find receptive audiences but often gain acceleration by tying into system-level priorities.

As noted in Part I of this series, VA utilization criteria and the criteria-for-use (CFUs) exert a primary influence on prescribing behavior. Achieving success requires early dossier submission, robust HEOR modeling, and, where possible, real-world evidence tailored to the federal patient population of the respective agency. VA stakeholders, in particular, tend to discount broad commercial data as “industry marketing,” preferring VA-specific outcomes, budget impact analyses, and case studies grounded in their own populations.

In this context, academic affiliates offer a valuable strategic pathway. When direct entry into a local VA hospital is limited, affiliated academic institutions can serve as gateways. Physicians at teaching hospitals frequently maintain dual appointments with nearby VA facilities, meaning adoption within the academic environment can spill over into the VA system, building both clinical credibility and operational momentum.

Lever 3: Sales Force Optimization – Precision Over Coverage

One of the most powerful levers available is sales force optimization. In the federal market, blanket deployment of commercial models is not only inefficient but often ineffective. Instead, success requires a federal-specific deployment model that balances reach with precision. Site selection must be data-driven, identifying the VA and DoD facilities with the highest potential impact. For instance, targeting the top 10 VA oncology hubs can capture a disproportionate share of high-need patients. Concentrating resources in these locations often generates greater impact than dispersing efforts across numerous low-volume sites by region. Manufacturers that adopt this approach consistently report higher ROI.

Equally important, sales teams must be equipped differently for federal accounts. Success depends on fluency in operational mechanics — such as ordering pathways, distribution processes, and local order set inclusion — rather than relying solely on broad efficacy claims. Training commercial representatives to incorporate federal-specific operational guidance into their discussions has proven far more effective in practice. Finally, both formal and informal “rules of engagement” must be respected to ensure access.

Not every facility warrants dedicated federal-specialist support, but select high-value targets must be approached differently. Manufacturers should evaluate partnering with, or outsourcing to, federal specialists in accounts where national thought leaders, training programs, and referral pathways converge to influence downstream adoption. Deploying federal-trained specialists, such as former agency pharmacists, into these settings can mean the difference between stalled access and breakthrough adoption.

In many cases, a single inpatient pilot is enough to create a launchpad for broader formulary reconsideration, as real-world utilization generates the evidence federal stakeholders require. Without such evidence, decision makers often default to established alternatives. When manufacturers can present outcomes tied to the unique populations of each health system, they also gain leverage for broader coverage discussions.

Achieving success in the federal healthcare system requires more than a “checking the box” approach. It demands a deliberate, nuanced, right-sized strategy based on deeper, more granular insights applied across three interconnected levers: external outreach, internal system engagement, and optimized deployment. The lessons learned from recent product launches, federal workshops, and decades of market experience is clear: success here is never about volume of effort. Instead, it is about precision: timing outreach with market events, aligning value with national initiatives, and deploying resources where champions and patient needs converge. Manufacturers who pull these levers in the right sequence build more than adoption. They build credibility, relationships, and spillover influence that deliver durable returns across both federal and commercial markets.

About The Authors:

Susan Pugh is a Principal and Co-Founder of Revolve Access, specializing in the development and execution of Federal launch and growth strategies.

Susan Pugh is a Principal and Co-Founder of Revolve Access, specializing in the development and execution of Federal launch and growth strategies.

Shannon Matwiyoff is a tenured pharmaceutical industry expert with expertise in the federal channel, both locally and nationally.

Shannon Matwiyoff is a tenured pharmaceutical industry expert with expertise in the federal channel, both locally and nationally.

Cheryl Middleton is a Principal and Co-Founder of Revolve Access, specializing in the development and execution of Federal launch and growth strategies.

Cheryl Middleton is a Principal and Co-Founder of Revolve Access, specializing in the development and execution of Federal launch and growth strategies.