Cytokinetics: Keeping Its Sights On Independence

By Wayne Koberstein, Executive Editor, Life Science Leader

Follow Me On Twitter @WayneKoberstein

UPDATE: 11/21/17 - Cytokinetics Announces Negative Results From VITALITY-ALS. Phase 3 clinical trial of Tirasemtiv in patients with ALS did not meet primary or secondary endpoints.

The Enterprisers: Life Science Leadership In Action

Can a biopharma company have a soul? If so, the soul should be one that endures. “The biology is the soul of our company,” says Robert Blum, president and CEO of Cytokinetics. “We have pioneered an area of biology — muscle activation — proven to offer a compelling pharmacology. Being the experts in the underlying science has enabled us to develop our expertise in the clinical research, and hopefully also affords us competitive advantages in the potential commercialization of our investigational medicines.”

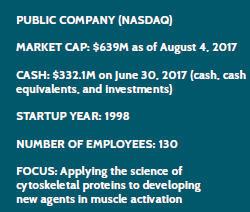

Blum speaks today from the farsighted perspective of a persistent company builder, determined to keep the Cytokinetics enterprise on an independent track. We first met much earlier in his company’s 19-year history, when it was just beginning to hunt through its founding science on cytoskeletal proteins for pharmacological targets and possible areas of application. Following the most promising path as it unfolded, the company repeatedly narrowed its search to arrive eventually at its area of focus: the mechanics of muscle biology, a key component adversely affected in numerous conditions, including ALS (amyotrophic lateral sclerosis) and heart failure. Many startups spend that much time failing in their original missions and starting over in new directions. But the Cytokinetics story is not about running to ground and reinventing the company. It is about implementing a long-range business plan long enough to see it through. Cytokinetics wants to maintain its independence right onto the commercial stage, taking its own products to the market and aiming for full integration, even as it now partners extensively with Astellas and Amgen in research and development.

INDEPENDENCE WAY

The first duty of a CEO is not only to understand the company’s science, but learn how to explain it. Blum introduces the concept of the cytoskeleton, essentially the structural network inside individual cells, as succinctly and clearly now as he did at our initial meeting.

The first duty of a CEO is not only to understand the company’s science, but learn how to explain it. Blum introduces the concept of the cytoskeleton, essentially the structural network inside individual cells, as succinctly and clearly now as he did at our initial meeting.

“Besides giving a cell its shape and organizing its parts, the cytoskeleton is a series of proteins involved in cellular activities that relate to mechanical movements,” he says. “How a cell divides, moves across a space, and communicates or coordinates with other cells, as when muscles contract — all are a function of cytoskeletal proteins that work together in networks. It is almost like an urban planning system for a cell, in which the proteins move along highways to carry cargo from place to place.”

In a decades-long collaboration, four scientists at Stanford, UCSD, and UCSF had pioneered research into the biochemistry of cytoskeletal kinetics and hatched the idea of turning the science to a medical purpose by founding a company. Instead of just jumping into fundraising and wading into business management, however, the scientist-founders recruited seasoned industry talent.

“On their own, our founders determined in 1997 the need to industrialize this promising area of academic research,” says Blum. “They knew their pioneering work had pharmaceutical relevance, but it had never been industrialized, and they thought it should be. So, they sought out employees like me who had successfully built companies, and together we found sources of capital.” Starting with business development and finance in 1998, he moved on to corporate development and R&D before assuming the CEO position by 2007.

Blum came to Cytokinetics with a set of experiences that would form the “architecture” he would apply at the company over time. From the 1980s, when he worked in sales, marketing, and business planning at Marion Labs and Syntex, through the 1990s, when he cut his teeth on startup construction at COR Therapeutics with mentor Vaughn Kailian, Blum gained some valuable knowledge about managing corporate assets, as in engaging company colleagues and investors.

“I learned a lot about company culture, how to treat people, and how to work effectively with stakeholders outside the company, and that had a meaningful impact on the way I thought about engagement, one to another. With Vaughn, I also learned a lot about how to build a successful biopharmaceutical company focused on a specific area of biology. But …”

But? Why the but? COR was manifestly successful, developing a category leader with the heart drug, Integrilin (eptifibatide). “But at the expense of a prolific pipeline,” Blum says. “Our lack of other newdrug candidates forced us into a position where the best thing for shareholders was to sell the company.”

In starting Cytokinetics, the idea was also to focus on one area of biology, as COR had, but without overconcentration on a single product. “From the very beginning, we’ve engineered into the fabric of the company a strategy of building a diverse pipeline of drug candidates, all moving forward together, in parallel. We can leverage partners, but we will still retain rights, responsibilities, and economics so, as we guide the company’s growth, everything doesn’t pivot on a single, binary outcome or clinical trial.”

The company’s commitment to full integration has opened up funding from a variety of sources outside the typical equity financings. “We’ve raised more capital through partnerships, up fronts, option exercise fees, sponsored research, and development-milestone payments, only occasionally going to the equity capital markets,” Blum says. “We have generated a pipeline of income sources that enable us to establish and maintain a leadership position in our area of biology. Our Series A investment round, which closed in 1998, was led by Roy Vagelos at Merck, Bob Swanson at Genentech, and two venture capital firms with complementary experience in building new biotechs.”

BECOMING A LEADER

But narrowing the company’s original focus demanded the discipline of an iterative process, as Blum describes it. “That is the difference between a biology-centric company and a chemistry- or technology-centric company,” he says. “We remained true to the biology, which enabled us to sharpen our focus over time to the specific slice of cytoskeletal biology related to the contractility of muscle.”

It was a strategic process as well. “In other areas, the competitive dynamics were too daunting for us to maintain a leadership position. But in the area of muscle biology, we thought we could be the leader and as the company matured, we would have an opportunity to monetize and multiply our investments. Pharmaceutical companies focused on bone health or metabolic syndromes were interested in muscle, and if we were the leading company in that space, we could do deals to leverage that expertise and generate sustainable cash flows to support our diversified business.”

When Cytokinetics first went public in 2004, however, it was because the stock market was excited about three drug candidates it had in oncology, in a partnership with GlaxoSmithKline. Yet it soon became clear the company would be unable to achieve or maintain a leadership position in oncology. It would have taken a much more mature and wealthy company to overcome the steep odds in such a crowded area, according to Blum. “A company like ours could not adequately maintain a durable edge in oncology.”

An intangible, but perhaps critical, property emerging from the focus on muscle contraction is the expertise and leadership Cytokinetics has achieved in the space, Blum suggests. “We know all the key opinion leaders, we understand the nuances of the regulatory constructs, we know this area like the back of our hand because we have been persevering and innovating in this space for decades,” he says.

MUSCULAR PIPELINE

The 2006 decision to focus on activators of proteins involved in muscle function has apparently proved to be a good one, based on the emerging portfolio of pipeline candidates. In Blum’s view, they are all first-in-class muscle activators covering a range of potential indications.

The company’s oldest and, Blum argues, most valuable development program is for a drug to treat heart failure: omecamtiv mecarbil. Discovered inhouse about 15 years ago, the drug activates myosin, the “mechano-chemical” enzyme that powers contraction of cardiac muscle. None of the existing heartfailure drugs safely raise cardiac performance. Some, called inotropes, only used in about eight to 10 percent of patients, boost cardiac output, but also increase heart rate, arrhythmias, and mortality risk.

“We wanted to find a compound that would activate cardiac myosin and increase the duration, not the velocity, of contraction,” Blum explains. “By increasing the duration, allowing adequate time for the heart to relax and refill, the drug would achieve an improvement in the efficiency without increased energy and oxygen consumption. We discovered and optimized omecamtiv mecarbil, and during the past 10-plus years in clinical trials mostly conducted by us, but some more recently conducted by our partner, Amgen, we have studied the drug in thousands of patients.”

Because the timing of the cardiac cycle is critical, so is dosing, which must stay within a range of 300 to 400 nanograms per ml, according to Blum. “Credit goes to Amgen for helping us develop a modified release form of the drug and a dose-titration strategy that keeps patients reliably in the therapeutic range.” Late in 2016, Cytokinetics and Amgen started one of two large Phase 3 trials planned for the next three to five years, potentially to support an NDA filing.

The partnership with Amgen started in 2006 when Amgen purchased an option on omecamtiv mecarbil, and the companies have extended and expanded it several times since then. Blum emphasizes the advantages of the relationship, from the multitude of clinical trials the two companies have conducted, to the terms of their joint commercialization agreement. Their current deal on omecamtiv mecarbil gives Cytokinetics the opportunity to earn total milestone payments from Amgen of more than $600 million, half of which are pre-commercial, as well as royalties on sales in the high teens to the low 20s.

“The royalty terms could be very advantageous to us if omecamtiv mecarbil becomes a multi-billion dollar drug,” Blum says. “We have the right to co-fund Phase 3 to buy up our royalty even higher, which we aim to do because it affords us the right to co-promote the drug in North America, where our sales force will be focused on the acute hospitals and Amgen would be focused on the chronic care outpatient centers. Amgen would be reimbursing us for most of our sales and marketing costs as well, so our royalty would be mostly profit. It’s not a profit-sharing deal, in which we would also share any net losses. Amgen is financing the building of our commercial business. It is a very unusual deal structure.”

A similar deal with Astellas is helping power the company’s most advanced program, for its first-generation fast-twitch skeletal troponin activator, tirasemtiv. When Amgen exercised its option on omecamtiv mecarbil in 2009, Cytokinetics deployed the considerable capital to tirasemtiv development. In plain words, the compound activates the protein troponin in fast-twitch skeletal muscle, as opposed to cardiac or slow-twitch skeletal muscle. Among a dozen or so clinical trials conducted with tirasemtiv, several are in the area of ALS, or Lou Gehrig’s disease. A Phase 3 study in ALS, VITALITY-ALS, is now concluding. “If we confirm what we saw in Phase 2, this could be the first muscle-directed drug approved for treating ALS,” says Blum.

Most people probably have only a vague idea of what came after Lou Gehrig’s “luckiest man in the world” speech at the end of the Gary Cooper movie. In the disease he experienced, the baseball hero could hardly have been unluckier. “Patients with ALS typically die within three to five years, and they die a horrible death,” says Blum. The prognosis in ALS is so severe, most neurologists are reluctant to render a diagnosis, instead relying on neuromuscular specialists, he says.

In the United States and Europe, both with a patient population of about 25,000, ALS is an orphan-drug indication with an active patient community. “ALS patients are the most selfless and courageous people you’ll ever know, and they’re highly motivated to participate in clinical trials, not necessarily to help themselves, but to help the next generation,” says Blum. “We’ve built up a tremendous amount of goodwill, and we have become a leader in the field. This is where it’s good to be a small company in a focused area — you can become a dominant player.”

Previous treatments under development for ALS centered on saving neurons from cell death. Tirasemtiv takes a different path and would be the first drug to treat the disease by activating muscle, aiming to increase muscle force and power and time-to-muscle fatigue. Tirasemtiv was the subject of four Phase 2a studies in ALS before undergoing the largest Phase 2 study in ALS ever conducted, BENEFIT-ALS, in 2013 and 2014. “The study showed an effect on respiratory function and muscle strength that had never been shown in ALS before,” says Blum. “We saw declines that were much less severe in patients on investigational drug than placebo.”

According to Blum, slowing decline significantly in ALS would greatly improve patient lives. Life span and the ability to work, feed, dress, and breathe independently all could be extended indefinitely by amplifying skeletal muscle response. For such a small population, the tirasemtiv trials have been unusually large, with more than 700 patients each in the completed Phase 2 and ongoing Phase 3 study. The latter is due to produce its first data by the end of 2017.

About the same time, Blum observes, the ALS Association is publishing a draft guidance document for the FDA — a call for action in accelerating drug development and looking at new endpoints such as the muscle metrics used in the tirasemtiv trials. “The advocacy community, the clinical research community, the FDA — everyone is very motivated — and our study is going to be the first Phase 3 trial to read out in this environment,” he says.

SELF-COMMERCIALIZATION

Cytokinetics is prepared to commercialize tirasemtiv on its own in the United States, Canada, and Europe, according to Blum, and Astellas has the option of developing and selling the drug everywhere else. He notes the community of ALS-treating physicians is a concentrated one and, with limited resources and access to capital, Cytokinetics should be able to build a commercial infrastructure and generate a profitable business.

Full integration — taking new drugs all the way through development, winning approval, and then selling them on the market — has always been the plan at Cytokinetics, Blum confirms. A company worth building is one worth keeping, apparently.

“Full integration is an advantage in attracting and retaining employees, allowing us to build a powerful and authentic company culture. Of course, we can’t just graft the commercial organization onto the company and maintain the integrity of our science and values. As we move to commercialization, our scientists will be actively involved in sales training, maybe even in sales and marketing, and rather than throwing something over the wall, they will be handing the baton to the commercial group. I’ve seen this work very well in companies that are the true leaders in other areas. The scientists want to make certain the sales and marketing people understand the story and can articulate it well, and the sales and marketing people have the thought leaders on hand by email or telephone.”

Most startup biopharma CEOs, it seems, cannot envision taking a product onto the market. Blum and his team can’t envision not doing so. The typical “exit strategy” is to get the company into mid-stage development, then license out assets or sell the entire enterprise to a commercial corporation. Cytokinetics wants to write a different story, and perhaps set a different example, for the industry’s enterprisers.