Grünenthal's Plan To Grow Globally & Expand Its Pipeline

By Wayne Koberstein, Executive Editor, Life Science Leader

Follow Me On Twitter @WayneKoberstein

The private, European-based company widens its base with new approaches and technologies for treating pain and, now, related conditions.

If you can spot it through the dense cloud of opioid- epidemic news currently emanating from the United States, some companies are developing new modalities for the treatment of pain. Among them, Grünenthal is a recognized catalyst. Like other pain-focused companies, Grünenthal has mainly pursued innovation with “abuse-deterrent” technologies and products for the prescription-opioid market. But now, along with a slew of partners, the company is identifying, studying, and targeting specific types, or “segments,” of pain, using new therapeutic mechanisms and technologies — even developing novel, non-opioid applications for its abuse-deterrent INTAC platform. It is also moving beyond pain into other, “adjacent,” areas.

Headquartered in Aachen, Germany, the familyowned, heritage company is well-known outside the U.S. market but has been nearly invisible inside it. Some of Grünenthal’s major products have reached U.S. patients by means of its partnerships with companies such as Depomed. But at this point, the company aims to establish a visible presence in the world’s biggest market as it grows into a more global organization. At the same time, it is building a pipeline of new products that would expand its therapeutic focus and produce novel drug-device combinations for specialty areas such as cancer-care support.

A View Of The Entire Value Chain

Gabriel Baertschi has been board chairman and CEO of Grünenthal only since last October, when he came to the company after a long tenure at AstraZeneca. Even so, his personal story seems to harmonize with a key narrative of the company he now heads — in short, applying the art of turning scientific discoveries into viable new medicines.

Impassioned by science, but especially excited by its application in medicine, Baertschi felt drawn to the pharma industry even in his school years. He followed his university study of biology by joining Servier in his native Switzerland in 1997, beginning in sales. After coming to AZ in 1999, he led the launch of major brands and explored the interface between the R&D and commercial functions. Later on, as AZ’s company president, first in Germany, then in Japan, Baertschi realized the positive results of integrating clinical and commercial development. He subsequently applied the integration strategy when heading a key therapeutic area for the company — gastrointestinal.

“It was good to have had sales and marketing roles, because it gave me some insight on how you develop a drug from A to Z,” he says. “Later in my career, having had both commercial and R&D responsibility gave me a view of the entire value chain from Phase 1 development to the commercialization of products. Now as the CEO of a company driven by innovation, I know we must put together the best science we have with the right commercialization efforts. And because it is not a huge company, we must accomplish the task in the smartest possible way.”

A Segmented Approach To Pain

Baertschi believes Grünenthal leads other pain-focused companies in the depth and breadth of its R&D programs aimed at the many facets of pain, as manifested in dozens of conditions with unique causes and effects. “Pain is complex,” he says. “We mapped out more than 100 types or sub-segments of pain, and many of them have no solution yet. The different approach we are taking at Grünenthal is to go after niche segments in pain. We are not interested in finding me-too solutions for broad-label indications.”

One example of Grünenthal’s segmented approach to pain is its development of potential treatments for the rare condition, complex regional pain syndrome (CRPS), an undeniably debilitating disease also known as reflex sympathetic dystrophy (RSD). CRPS is an orphan disease in the United States, with less than 200,000 sufferers. “CRPS is considered more painful than an amputation or giving birth,” says Baertschi. “And there is no therapeutic solution yet available.” The company has two non-opioid compounds in development for the condition: the bisphosphonates neridronate, or neridronic acid, in IV form; and zoledronate or zoledronic acid in oral-dosage form, which Grünenthal acquired with its purchase of Thar Pharmaceuticals in November 2016. “Our compounds really put us in the lead of bringing patient solutions to the CRPS space.”

It is worth hovering above the CRPS space for a moment, just to appreciate how a chronic pain condition can be chronically acute. “Those patients cannot take their grandchildren in their arms because it’s too painful. They cannot grab a glass of water. A patient explained to me that she cannot even stand the air-conditioner flow on her skin. Patients feel attacked the whole day, and that’s why they also tend to develop depression and have higher suicide rates than the general population.”

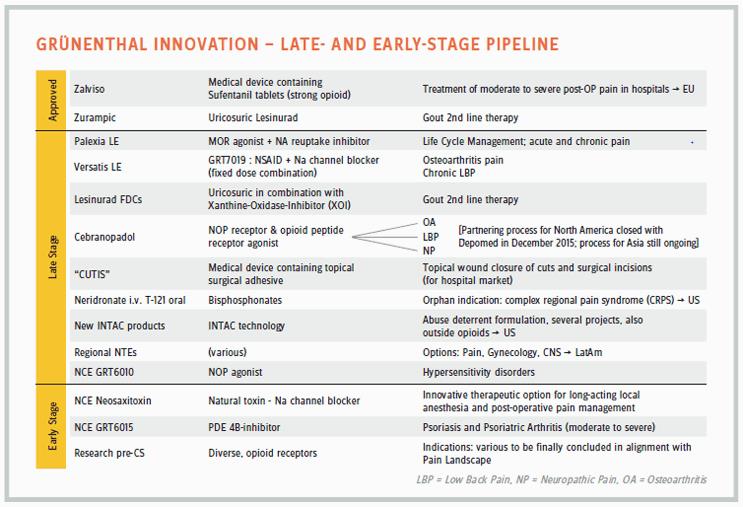

Other pain segments targeted by Grünenthal include gout, with the approved drug Zurampic (lesinurad), a URAT1 (urate transporter) inhibitor; long-acting local anesthesia and post-operative pain management, with neosaxitoxin, a natural toxin and sodium-channel blocker; and psoriasis and psoriatric arthritis, with candidate GRT6015, a PDE4B (phosphodiesterase 4B) inhibitor. A pipeline chart also refers to new therapeutic “options” in pain, gynecology, and CNS to be developed in regions such as Latin America.

“We tried to understand the physiology behind many conditions, and we realized some of the pain receptors are overexpressed in some of the organs,” says Baertschi. “One of them is in the bladder, and we had a compound that fit very well against that receptor but was initially developed for a completely different condition, so it was repurposed for bladder pain.” The candidate compound GRT6010 would be the first NOP (nociceptin opioid receptor) agonist on the market and the first therapeutic for bladder pain. It is a condition affecting a small group of patients, he says, “But these patients have to go to the loo 30 to 40 times a day, and they cannot even sleep. There is no treatment available for them. We just moved into Phase 2 with GRT6010 to explore the effect in bladder pain, but also in stump pain and other hypersensitivity disorders.”

Although many of Grünenthal’s development pipeline candidates employ non-opioid mechanisms, the most ancient of pain-relief modalities has not seen its last days, according to Baertschi. “Opioids have a somewhat bad reputation, but there are differences among opioids. Some opioids do not generate addiction as much as others; it depends on which opioid receptor you act on.”

One avenue in the company’s research line is the ORL1 (opioid-receptor-like 1) portfolio, a series of substances which activate a pain relieving pathway lacking typical opioid side-effects. “Given their unique expression in human tissues, these novel analgesics may serve to treat niche indications with high unmet need and currently being without standard of care,” he says.

A North American partnership with Depomed also covers cebranopadol, an NOP receptor and opioid peptide receptor agonist, in development for low back pain. The two companies also have a commercial relationship in the U.S. market with Nucynta (tapentadol), sold elsewhere by Grünenthal as Palexia. Depomed sells the drug in immediate and extended-release forms, formulating Nucynta ER with its own long-acting, oral-delivery technology, Acuform.

Broad Franchise & Beyond

Companies that play in the pain space tend to stay in the pain space, pretty much exclusively. But most of the historically pain-focused companies, such as Grünenthal and its close cousin Purdue, seem to have reached the point of expansion beyond old boundaries. Although Grünenthal’s plans vary somewhat between geographic regions, new areas of research and development include perioperative care, cancer supportive care, and focused and specialty drugs, many combining drugs and devices. In Europe, the company also targets movement/bone disorders, neurology, and hospital-based products; in Latin America, women’s health and the CNS areas. The common denominator, however, is still pain — the products in all of the focus areas will be for uses “adjacent” to pain.

As with similar companies under family ownership, the private company model gives Grünenthal the freedom to take a longer point of view than public companies can sustain. “You can really build value over time,” says Baertschi. “But I would say there is no space for waste. When it’s family money, you need to invest it extra carefully and prudently.”

Will Grünenthal continue to expand its therapeutic and geographic horizons, becoming more like a publically owned, diversified company in the mold of Big Pharma? Or will the privately owned, more focused model, where pain is the hub of related products and services, endure as the most practical option for a company in this particularly difficult area?

There is no indication Grünenthal will morph into a Big Pharma in anyone’s idea of a likely future. Even large companies concentrate on selected areas, according to their resident capabilities, Baertschi observes. “You focus on your area of expertise. It is not easy to acquire an area of expertise outside a field you have been building over the years. That being said, I’m not agnostic to building something beyond pain, and we have started that last year by building therapeutic fields that are adjacent to pain. You can look at pain from a CNS point of view or an inflammatory point of view, and the universe around pain is broader than just treating the pain symptoms. That is why we are building up the gout franchise and bought lesinurad [Zurampic] from AstraZeneca. We are looking at inflammation in general. Beyond gout, we have other products for which we are also seeking partners.”

Some partnerships are taking Grünenthal even further afield; the company is marketing Arcoxia (etoricoxib) in Europe for broad pain indications, but the company wants to explore the drug’s potential at the far end of neurology: Severe Parkinson’s. “Last year we made about 39 deals, and I hope we can continue at the same pace this year. It’s very important that we focus on pain, but there are many conditions closely related to pain. It’s the same doctor treating the pain syndrome and the cause of the pain, so it makes a lot of sense to offer a holistic solution.”

In gout, emerging science shows the condition is a degenerative disease, not diet-related as popular myth maintains. This knowledge opens up a new world of possibilities for treating the age-old scourge. As Grünenthal entreats small companies with gout candidates to come forward as potential partners, it also prepares to educate the medical community accordingly. “We are actually trying to change the perception of gout,” Baertschi says. “We would look at the companies with new compounds that could be interesting to use in one of our pain subsegments where we have a good understanding about the pathway, and perhaps the molecule they have could work. They may know the drug can work on some pathway, but they don’t know how to develop it in pain, so we try to be the partner of choice in the pain field.”

Geoexpansion Time

If you get the feeling Grünenthal has just stepped out from behind a curtain, you may be excused. Truth is, the company has been as quiet as its “private” status denotes. Only quite recently has it sought a higher profile, especially in the United States. It would also be logical to surmise Baertschi’s arrival only three months before the new year was more than a coincidence with the emergence. The emergence is his agenda.

“I think there is much more we can do with Grünenthal in general,” he says. “We’re a €1.4 billion company. Our aim is to become a €2 billion company, and to do that we need to expand our global footprint, be more visible in the United States, in particular. We want to make sure we can access the best science in the United States as well, so one reason I’m trying to be more vocal about what Grünenthal has to offer is to power our research. Then we have compounds in the pipeline we would like to commercialize in the U.S. market, such as the CRPS drug. We currently don’t have our own commercial infrastructure here in the United States, however, and we might need to find a partner for some of our products.”

Although the company aims to become more global over time, Baertschi describes the present state of the company as international. About half of its business and infrastructure is in Europe, the other half, in Latin America, with both regions growing at a healthy 15 to 20 percent, but almost no standing in the United States, Japan, or Asia. In North America, where the Grünenthal subsidiary mainly operates the INTAC partnerships, the company’s pharma presence is through commercial partnerships such as Depomed’s sales of Nucynta — worth about $300 million now and growing rapidly. Grünenthal partners with Patheon in applying the INTAC platform to U.S. companies. Not only does Baertschi want to see the company grow in North America but also in Asia. “I cannot foresee a future for Grünenthal with no partnership or commercialization in Asia. There is a need for our products there.”

Grünenthal’s European perspective may prove to be an advantage these days as payers gain power worldwide, and the pharma value proposition faces new tests in the current populist ascendancy. Even in the United States, where private payers still present the greatest challenge, public power offers more a mixed blessing than unqualified support to the industry — a possible tradeoff of drug-price negotiation for radical deregulation.

“Whether it’s the private sector or the government challenging us, the principles are the same,” he says. “You need to show that your product brings new value to society. Payers no longer want to pay for me-too medicines. In that sense, the value model has evolved more quickly in Europe, and also there is great science in Europe, as in the United States.”

At the same time, Baertschi says the United States is also a very attractive place for Grünenthal. “We want to have more scientific presence and eventually commercial presence in the United States one way or another, either through a partnership or going it alone, depending on how our pipeline is moving.”

Another intrinsic advantage for Grünenthal in the U.S. industry sector could be its moderate size. The simpler, more entrepreneurial organization could make the company especially attractive to industry talent laid off or alienated from large companies and looking for a new home. It might offer a kind of halfway house for industry veterans drawn to its startup-like agility, yet knowing it has the critical mass needed for all stages of R&D and commercial competition. Likewise, would-be entrepreneurs otherwise bound for the startup space may find the same qualities attractive. Baertschi would welcome both types to the company.

In-House Manufacturing

If there is any field where Grünenthal has a real lead, it may be in the continuum of formulation to production loosely called manufacturing. Though the company does some outsourcing where it lacks specific expertise, it maintains the capabilities needed to take compounds all the way from the bench to the clinic, from synthesis and formulation to full-scale production and supply. It even makes its own API. (See also “Grunenthal’s Technology Model For The 21st Century,” Outsourced Pharma, August 2016.)

“We really are a fully integrated company,” Baertschi says. “It is nice to be in control of everything when you’re small because you’re not dependent on the API prices from another company. For some of our products, we beat the most cost-effective suppliers based in India. We can produce it cheaper because we know the best ways to do it. When we develop a drug, we use all of the steps in chemistry to engineer the molecule in the best possible way. That strengthens the resilience of our scientists and chemists, who might be tempted to give up more quickly on a product if they didn’t have the know-how and persistence to do it right.”

Baertschi says in-house manufacturing also gives the company a great deal of flexibility in packaging and quantity adjustment for various markets. “We are just more nimble having our own manufacturing sites. Will it always be necessary to have as many manufacturing sites as we have now? That’s something I cannot answer today, but we will have to look at that.”

More Partnering In Future

Four late-stage drugs in the pipeline — with high medical need indications in pain segments or adjacent areas — hold the potential to propel Grünenthal to its overall goal of expansion in annual sales during the next few years. Some of those may also push the company into building a greater infrastructure in the United States and elsewhere. Meanwhile, says Baertschi, the company will increase its presence in the scientific community and enlarge its network of external research partners — while continuing to strengthen its commercial capabilities in Latin America and Europe.

It seems natural: If we’re going to have pain-focused pharma companies, they will evolve and spread to all corners of the world. If pain is global, so should be the medical relief of pain, even if all the accompanying issues apply: abuse, addiction, and let us not forget, denial of treatment to many who desperately need it. Some may call it self-interest, but Grünenthal is offering a well-founded alternative vision of pain as a complex set of conditions and mechanistic causes. Yet a steep education curve lies ahead, in Baertschi’s view:

“Pain is penalized; it is regarded almost as a commodity disease, and I’d like to change this perception. There are still many pain areas that have no medical solution. We have patient days where we invite patients suffering from all kinds of pain, and when you listen to them, you realize there is still so much work left to do.”

Pain patients — people in unbearable and perhaps intractable suffering — obviously hope someone is listening. As long as such pain exists, people will look to the medicine makers for solutions. And Grünenthal will be one to answer the call.

Global Pain, Patient Pain

A discussion with CEO Gabriel Baertschi about how various cultures and practitioners regard the treatment of chronic and acute pain with the medications Grünenthal and others make available.

HOW DOES THE PAIN SPACE OR MARKET DIFFER AROUND THE WORLD?

BAERTSCHI: Pain is a global burden. Starting with the United States, pain is costing the healthcare system $560 billion a year — half of it being direct cost; the other half, indirect cost of people being unable to work and so on. About 116 million people in the United States suffer from severe pain, indicating the dimension of the burden, and pain is universal. It is everywhere in the world. Now, the way pain is being treated is different from one country to another. In Japan, pain is traditionally something one should accept more than people do in the Western world, but that’s changing. Grünenthal can contribute to educating physicians and healthcare providers in Japan about the need to treat pain there, because it has a societal impact. If you’re not treating pain well, it costs money to society.

ONE OF THE DIFFICULTIES IS YOU CAN’T MEASURE SOMEBODY’S PAIN OBJECTIVELY OR PROVE THAT IT’S THERE.

Well, it’s true that it’s difficult, but you can measure it. There are validated scales used by regulatory authorities when you want to have a product approved.

IT’S JUST NOT USED IN DAILY PRACTICE.

Most general practitioners are not using it, but specialists do.

A PAIN PATIENT GOES IN AND TELLS A DOCTOR, “I HAVE PAIN,” AND THE DOCTOR SAYS, “POINT TO YOUR PAIN LEVEL ON THIS 10-POINT SCALE.” BUT THERE’S NO WAY TO PROVE THE NUMBER IS ACCURATE, SO IT BECOMES A SUBJECTIVE MATTER.

That is why we try to help physicians describe pain precisely, because then they can also look at the right therapy for that specific pain. We did a lot of work to actually map out these pain types and help understand what is the best drug that fits the condition. A typical neuropathic pain, for example, has a different component from acute pain. We have a big campaign in Europe called CHANGE PAIN, which is exactly about helping physicians understand the pain components and then make the right choices from a therapeutic point of view. We also did an initiative with the European Union on the societal impact of pain in Europe. Today, very little money goes into research of pain; in the United States, it’s only about one percent of the entire research funds. And there is not always a willingness to pay for pain therapy. We have made some studies in Europe that found, for every pound you spend in the UK on Palexia rather than other pain therapies, you save two pounds on indirect spend.