Partnering To Commercialize Radiopharmaceuticals

By Ben Comer, Chief Editor, Life Science Leader

During a July episode of the Business of Biotech, Ebrahim Delpassand, M.D., founder, chairman, and CEO at RadioMedix, pointed out the importance of knowing, as a company, what you do best. It won’t be everything, particularly if you are developing a new radioactive diagnostic or therapeutic and are not among the ranks of Big Pharma.

“In the case of our first product that received FDA approval in 2020 — the diagnostic agent copper-64, or Detectnet — we knew how to develop the study,” said Delpassand. “We knew how to perform the clinical trials. But for the commercial launch of the drug, we thought we would need to partner with a big company that has done this many times with other drugs.”

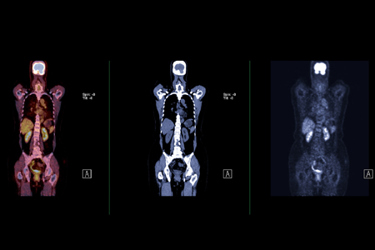

In the burgeoning radiopharmaceuticals space, particularly in light of the complexity of supply chains, just-in-time manufacturing, and the provider capabilities needed to administer radioactive products to cancer patients, commercial know-how is paramount. For midsized and smaller radiopharmaceutical developers, building a global commercial enterprise internally is often not an option, and represents an even larger and more expensive hill to climb than small biotechs developing other drug modalities. As radiopharmaceuticals move into new cancer types, and even beyond cancer to other therapeutic areas, commercial strength (or lack thereof) will become an important product differentiator leading to market success or failure.

Engaging A Partner

In the case of RadioMedix, Delpassand landed on Curium Pharma as an out-licensing partner, for several reasons. “Curium had cyclotron facilities in St. Louis that can make copper-64 for us, and they also had experience in commercial launch,” said Delpassand. “Developing a drug is one thing, but navigating insurance companies, third party payers, contracting with them, having a strategy in terms of public awareness of the product, as well as then manufacturing and making sure that you can deliver in the commercial phase … it’s a totally different ballgame than, say, making a drug for an investigational trial.”

Curium already had “boots on the ground” selling Octreoscan, a neuroendocrine cancer diagnostic, said Delpassand. Licensing RadioMedix’s Detectnet diagnostic to Curium helped to make the commercial launch a success, leading to Detectnet capturing “more than 70% of the market,” despite the availability of a competing product approved at an earlier date. “We have a majority of the market because of Detectnet’s ease of use, and because it’s centrally manufactured and available throughout the country,” said Delpbassand. “Wherever there is a PET scanner, Curium can ship the product and patients can benefit.”

Partner Perspective

That Boston relocation was a strategic choice, because “Boston has the greatest concentration of oncology research in the world,” says Patterson. “It’s a good place for us, because we’re putting 100% of our profit from the company back into developing new products and getting them to market.”

Curium is looking to the future, beyond neuroendocrine and pancreatic cancers in the near term, and plans to do additional in-licensing deals, and perhaps even a future acquisition. “We believe that 80% of cancers can be attacked using radioligand therapy, so we’re targeting all avenues to identify the right products to help patients.” Patterson adds that “there may be times where we want to in-license or acquire a peptide, for example, that we believe will be an excellent candidate to attach to an isotope to attack the tumor.”

Regarding the RadioMedix in-licensing deal, Patterson notes that no one had ever commercialized a copper-64 asset prior to Detectnet. Curium is currently the “only company with a copper-64 isotope on the market … due to our capabilities in terms of our cyclotrons in St. Louis, but also our know-how in developing copper-64 in the volumes needed for commercialization."

“We’ve been in the neuroendocrine space for 30 years now … we know all the KOLs in the space, we know where the treatment centers are, and we understand the patient,” continues Patterson. “That’s really critical to combining [RadioMedix’s] skillset of what they helped develop, and our skillset of being able to manufacture and distribute products reliably, combined with our commercial capabilities which includes engaging those thought leaders and really the [patient] advocacy groups, which should never be underestimated in a rare disease like neuroendocrine tumors.”

At the global level, Curium operates in more than 60 countries, and has a direct presence in Europe, China, India, Turkey, and Mexico, with distributor networks covering the Middle East, Africa, Australia, Latin America and Asia Pacific. In the U.S., the company is expanding, with a second expansion planned for the St. Louis site, and a therapeutic center of excellence in Noblesville, Indiana, says Patterson. “We’ll be making all of our lutetium product [in Indiana] for shipping across the U.S., as well as Canada, Mexico, and potentially South America. We’re really focused on a U.S. centric manufacturing platform right now for products in this hemisphere.”

Preparing For Growth In Radiopharmaceuticals

As new development candidates grow in number across company pipelines, and indications expand beyond neuroendocrine tumors, pancreatic and thyroid cancers, successful (and reliable) source materials, manufacturing and supply chain, and commercial distribution will be key to the success of new radiopharmaceutical products.

For smaller radiopharmaceutical development companies, finding a partner to help ensure that approved diagnostics and medications can reach the patients who need them will become a prerequisite. Identifying and engaging with potential partners early in the development process, based on an individual product’s therapeutic area, anticipated payer coverage, distribution needs, and patient access, will be a difference maker and differentiator for new products.