Pharma Industry Lacks Consensus On Key Attribute Of A Sponsor-CMO Relationship

By Kate Hammeke, VP of Market Research, Industry Standard Research (ISR) @ISRreports

Over the past several decades, the practice of outsourcing has evolved from transactional, client-vendor relationships where cost savings were the primary focus, to preferred provider relationships with pre-vetted companies to start up projects quickly and then to relationships more strategic in nature to gain access to technologies, skills, or expertise not possessed in-house. Regardless of your level of outsourcing experience and approach, it is important to know there are tools available to make this time-consuming and complex process of selecting and vetting a manufacturer simpler and more effective in meeting your needs for a qualified supplier.

Life Science Leader’s annual CMO Leadership Awards is one of these tools. The data — collected by Industry Standard Research, a full-service market research provider to the pharma and pharma services industries — that serves as the foundation for the awards is experience-based and brings an important component into the CMO selection process: how the CMO performed for its current and recent customers relative to their expectations. While the adoption and implementation of outsourcing strategies is diverse, feedback from peers on their experiences when working with specific manufacturers is inherently valuable for guiding your own CMO selections.

The 2017 CMO Leadership Awards result from the feedback of 339 industry peers and reflect 1,755 service encounters with more than 80 CMOs’ offerings, including drug substance (small molecule and biologic) and drug product manufacturing activities. ISR screens for involvement with outsourced manufacturing and/ or decision-making influence on contract manufacturer selection to ensure the respondent group is relevant for providing feedback on outsourced manufacturing activities. This year, the respondent group includes 44 percent of participants from large biopharma (R&D $1B+) companies and 56 percent from small and midsize biopharma companies. The majority of respondents work for companies headquartered out of North America (71 percent) and Western Europe (27 percent); a small proportion are based out of the Middle East and Japan (2 percent). Interestingly, four out of five respondents mentioned the company they work for has a large molecule offering; in fact, most respondents work at companies that currently have both marketed biologics and biologics in development (57 percent). All this is to say, the data that identifies the CMO Leadership Award winners comes from a well-qualified group.

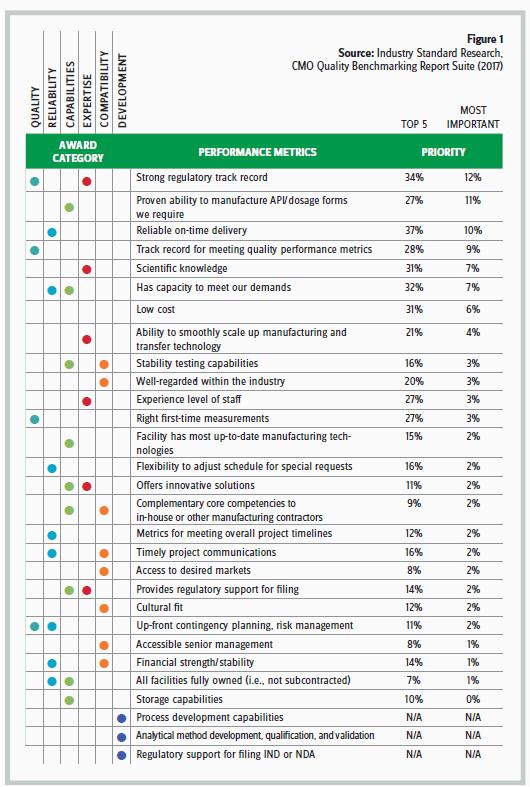

To help Life Science Leader’s readers understand more about these industry peers, ISR asked participants in the research to prioritize a list of metrics as “Top 5” and the “Most Important” when it comes to selecting a contract manufacturer. This information will help new outsourcers know which attributes have contributed to successful outsourcing relationships in the past, and it will help experienced outsourcers identify CMOs based on information from peers who share their same outsourcing priorities. This can be especially important when there is a lack of consensus around the most important attribute for a CMO to possess.

For the second year in a row, A Strong Regulatory Track Record topped the list as the most important attribute influencing CMO selection according to 12 percent of respondents and was in the top 5 selection criteria for one-third of respondents. The Proven Ability To Manufacture API/The Dosage Forms We Require placed second with 11 percent of respondents indicating this is the most important selection criterion and one-quarter of respondents including the attribute in their top 5. With 10 percent of the vote, Reliable, On-Time Delivery netted third position for the most important selection attribute and captured 37 percent of respondent votes as a top 5 selection attribute. Following closely at 9 percent and in fourth place for the most important selection attribute is a Track Record For Meeting Quality Performance Metrics. This attribute was among the top 5 for 28 percent of respondents.

After these first four attributes, which were each deemed the most important criterion by ~1 in 10 respondents, there is a drop-off, and the next three attributes are perceived most important by ~1 in 20 respondents; the next drop-off is more substantial, and the following 18 attributes were ranked as most important by anywhere from 1 in 33 to 1 in 100 respondents. This pattern shows how some metrics carry a substantial amount of influence for different parties in the outsourced services buying audience; this lack of consensus leads to a cloudy decision-making process because no specific criterion dominates the CMO selection decision. Unfortunately, ISR’s research suggests this trend toward greater diversity in selection criteria is going to continue to grow rather than to consolidate around specific metrics.

These same attributes are used as evaluation criteria for each contract manufacturer included in the study. Figure 1 displays how the performance metrics are classified by buyers of outsourced services and the performance metrics that correspond to the award categories. Respondents who have worked with a company within the past 18 months or are currently engaged with the CMO can rate the contract manufacturer on its performance relative to expectations.

Using insight from industry peers on the CMO attributes that contribute to a successful outsourcing relationship along with performance ratings can help your outsourcing decision-making unit streamline the shortlisting process. Match your own priorities and project needs with companies that have proven to excel in those areas — and feel confident because the process is guided by data based on recent customer feedback and insight from experienced outsourcers. The 2017 CMO Leadership Awards winners represent the CMOs that have performed the best on these metrics for their customers. A variety of contract manufacturers in terms of size and offering are winners this year. So, whether your company’s preference is for a one-stop shop with an end-to- end offering, or your projects have unique requirements only available at niche providers, know that these companies come with the “seal of approval” from your industry peers.

Survey Methodology: Industry Standard Research’s Contract Manufacturing Quality Benchmarking research is conducted annually via an online survey. For the 2017 CMO Awards data, more than 80 contract manufacturers were evaluated on 27 different performance metrics. Research participants were recruited from biopharmaceutical companies of all sizes and screened for decision-making influence and authority when it comes to working with contract manufacturing suppliers. Respondents only evaluate companies with which they have worked on an outsourced project within the past 18 months. This level of qualification ensures that quality ratings come from actual involvement with a business and that companies identified as leaders are backed by experiential data.