Prometic: New Tech Harvests Orphan Treatments

By Wayne Koberstein, Executive Editor, Life Science Leader

Follow Me On Twitter @WayneKoberstein

The Enterprisers: Life Science Leadership In Action

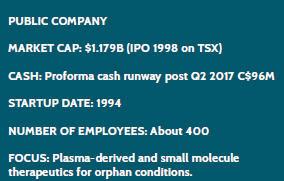

Always stick with your original goals, even when you reap another, off-the-scale success. Like many biopharma companies, Prometic invented a novel technology platform, initially to make new medicines available to unserved populations. It never strayed from that path, but its platform proved to be enormously useful in many other ways. Thus, again like many biopharmas, Prometic came to straddle two sides of the business: as a technology supplier to other companies, and as a developer of its own original products, most of them for treating orphan conditions. It is impossible to discuss the latter without explaining the former, yet this story centers on the company’s founding purpose — bringing those new treatments into being.

FINDING METHOD

Prometic, born first of the academic world, began its business existence by the actions of Pierre Laurin, founding chairman and current CEO. As a pharmacologist looking to invest in a company, Laurin believed the industry could do a better job of producing pure, safe, and effective medicines. He became interested especially in blood fractionation, which had delivered plasma, albumin, and other vital blood products using a methodology devised by Dr. Edwin Cohn in World War II. Still in use as the primary means of fractionation worldwide, the Cohn method involves precipitating blood products in ethanol, a highly volatile substance requiring extensive safeguards in the multi-stage manufacturing operations.

Prometic, born first of the academic world, began its business existence by the actions of Pierre Laurin, founding chairman and current CEO. As a pharmacologist looking to invest in a company, Laurin believed the industry could do a better job of producing pure, safe, and effective medicines. He became interested especially in blood fractionation, which had delivered plasma, albumin, and other vital blood products using a methodology devised by Dr. Edwin Cohn in World War II. Still in use as the primary means of fractionation worldwide, the Cohn method involves precipitating blood products in ethanol, a highly volatile substance requiring extensive safeguards in the multi-stage manufacturing operations.

The old method is also limited to the most abundant blood constituents, leaving many, scarcer but potentially useful substances in the waste products remaining after the process. It occurred to Laurin that, if those constituents could be recovered with a better technology, they could be developed as treatments for many patients who suffer rare diseases because their own bodies fail to produce those proteins.

In 1989, Laurin encountered ACL (Affinity Chromatography Ltd), then an early-stage spinoff of the U.K.’s Cambridge University. Through ACL, Cambridge had been looking for ways to commercialize a product of its research into “mimetics,” or chemicals that could display “novel affinity ligands” mimicking those found on proteins. The general target at the time was protein purification, which resonated with Laurin’s core idea.

“I wanted to invest in something less mundane than a drug-delivery system, but when the Cambridge scientists were explaining to me this technology, the only metaphor I could imagine was Velcro,” he says, “It could have countless applications. But I was dead right and dead wrong — right that the technology worked and dead wrong that it would only take the money I had myself to put the project through. It became much bigger than I ever imagined.”

Laurin ultimately gathered enough money to buy the Cambridge spinoff, refounding and relaunching the company as Prometic Life Sciences in 1994 and bringing it on the Toronto Stock Exchange in 1998. Because raising funds in Canada would be easier than in the U.K., the company opened operations in Canada, where it subsequently began producing its affinity filters. For the rest of the 1990s and into the 2000s, Prometic grew substantially with its technology business alone, though it experienced numerous business and financial setbacks, from small to large, along the way. At some point, it may well have looked as if the company had forgotten its original mission, to develop its own therapeutics, beginning with the rare blood constituents lost in the Cohn process. Then an angel arrived to show it the way.

In 2000, the company received a big boost in applying its technology to blood-borne proteins from an unexpected but not unlikely source. The American Red Cross approached the company with the aim of developing better ways to rid donated blood of impurities and infectious agents. It also saw the potential of Prometic’s technology to extract valuable blood products too sparsely present in plasma to harvest by the old process. At first, the primary concern was ridding the blood and plasma-derived products of prions causing Mad Cow disease, but the subsequent extraction programs grew to include multiple contaminants and potential therapeutic proteins. The company also gained extensive new expertise and knowledge in proteomics as a result of the projects.

Two joint ventures with the American Red Cross helped the company scale up the mimetic plasma- screening and protein-extraction process to industrial levels in less than two years. In the wake of Hurricane Katrina in 2005, however, the U.S. Congress ordered the federally funded group to concentrate solely on disaster relief and abandon all commercial development with companies such as Prometic. Loss of the Red Cross partnership was a major setback for the young company, after growing rapidly to hundreds of employees and multiple sites in the USA, the U.K., and Canada. It lost two major partners, one to bankruptcy, and it struggled to keep up its cash flow as it fought to secure its IP.

“If we had been private, this would have been a nonevent — we would just find more money and go on,” says Laurin. “But we’re public, and therefore the perception was, ‘This will never work, stop launch!’ To the folks on the boat, it looked like it was sinking. But when we realized we were still on the surface, even more good people had joined our crew, and we sailed on. That was a proud moment. Scientifically, our job then was just to execute, but you need the right people on board to execute. You need smart people on board to execute. So that was the trick.”

In fact, the Red Cross alliance had generated some valuable commercial products. After Prometic successfully resolved its patent litigation with a former manufacturing supplier and raised more funds, the company essentially came out of the crisis with a new business on its hands. Like companies many times its size, it restructured into four discrete business units, with several units dedicated to the supplier side and the Prometic Biotherapeutics unit developing drug products in Canada.

After Shire acquired BioChem Canada in 2001, Prometic hired many of BioChem’s scientists for its nascent drug-development team. It was a pattern that would repeat; Prometic has made liberal use of partnering and acquisition to augment its expertise and technology for all of its businesses.

BACK TO THERAPEUTICS

The first blood plasma-derived product in Prometic’s therapeutics pipeline is plasminogen — now at the BLA (Biologics License Application) stage on the accelerated approval pathway with an indication for congenital plasminogen deficiency (CPD), and entering clinical development for wound healing. Normally produced by the liver, plasminogen circulates throughout the body and, when activated, becomes plasmin, a protein with a critical role in lysis (destruction) of blood clots and excess fibrin in the body.

Thus, as the company says, plasminogen is “vital in wound healing, cell migration, tissue remodeling, angiogenesis, and embryogenesis.” When a stroke patient receives TPA (tissue plasminogen activator), for example, the body must have sufficient plasminogen to halt the TPA’s clot-busting reaction before it causes massive bleeding. One of the target indications for Prometic’s plasminogen product is for use with TPA. But first on the roster of goals: Some people are born without the ability to produce enough plasminogen, creating truly horrible symptoms such as lung and skin lesions, and plasminogen augmentation may also promote healing of especially stubborn wounds.

The plasminogen product has benefited from some extraordinary evidence. Laurin describes what happened when Dr. Sara Bein, a psychiatrist and CPD patient, received a dose of the protein: “Dr. Bein had gone through 106 surgeries for blood clots and fibrotic complications and had been near death three times in her life, and she’s now 34. When she joined our Phase 1 clinical trial for plasminogen deficiency, she had only 67 percent lung function, with one lung collapsed, and she was scared. She took the first infusion, and plasminogen started traveling in the vein. Within minutes, she started having a coughing fit, and she spat out the fibrous tissue that was blocking her lung. With the before and after pictures, that was evidence extraordinaire for the FDA.”

Indeed, the agency took a look at the Bein story and — after strong Phase 2/3 results as well — excused it from doing an additional Phase 3 efficacy trial. Perhaps the decision also helped accelerate the company’s discovery of other potential indications for its plasminogen. “We had thought we were just dealing with congenital deficiency and that would be it; we’d move on to other things. But as we started meeting more KOLs in this field, the monster kept growing,” says Laurin. Other plasminogen indications now under investigation include acute lung injury, diabetic wounds, and closed wounds in the ear.

The Phase 3 trial for CPD was exceptionally small, only 15 patients, which the FDA allowed because plasminogen is a well-characterized natural protein. The product’s accelerated status also allowed the trial’s use of surrogate endpoints, which would normally require a post-marketing Phase 3 trial within six years. The primary endpoint was at least a stable 10 percent rise in plasminogen levels in patients during treatment along with an observed reduction in symptoms; the secondary endpoint, 50 percent of the patients having 50 percent less lesions, one of the most common symptoms of the condition.

Following plasminogen, Prometic has a long list of plasma-derived proteins in the pipeline. Now in Phase 3 for treating primary immunodeficiency diseases (PIDD), intravenous immunoglobulin (IVIG) leads the pack, followed by others at the IND (investigational new drug) stage including fibrinogen for fibrinogen deficiency, alpha-1 antitrypsin (AAT) for AAT deficiency, and C1 esterase inhibitor (C1-INH) for hereditary angioedema.

LARGE LEADS TO SMALL

In early 2000, Prometic added small molecule capability to its drug discovery and development organization, augmenting the plasma- derived therapeutics. It set up its therapeutics operations in the United States, counting on the usual practice of U.S. FDA approvals driving authorizations in other countries. Although it may seem odd for a plasma-extraction technology to lead into small molecule drugs, that is exactly what happened, Laurin explains:

“We make molecular ligands that mimic the protein-protein binding interaction. For a ligand to be commercially viable, it must have an ability to break that bond, allowing for the elution of the protein. When I first looked at our library of ligands, I realized that some of them bound so tightly that they would not allow the elution of the protein. We actually had a library of compounds with high affinity and binding tightly to protein receptors — exactly what one needs for effective drugs. The small molecule division was born.”

At that point, Laurin began licensing rights to drug candidates to increase the depth of the pipeline. The portfolio now has candidates targeting fibrosis, autoimmune diseases, and oncology. The lead compound, coded PBI-4050, is in Phase 2 for metabolic disease, diabetes Type 2, and other conditions.

Laurin says the small molecule business is a separate division with its own research, development, and commercialization focus. “The IP is domiciled in the U.K., and is controlled by a sub-board of Prometic. Most of the R&D is commissioned to our research group in Canada, many of whom joined the company from BioChem.”

Originally, the plasma and small molecule groups operated quite separately, but the common goal of therapeutics, pushed along with the progress of plasminogen, has increasingly united the two. “Our scientists are focused on the biology of healing, irrespective of the source of the drug,” says Laurin. “Moreover, the clinical regulatory and medical affairs departments are driving the clinical development of all drugs irrespective of whether they are orally active synthetic pharmaceuticals or plasma-derived biopharmaceuticals. At this point, what matters more is the therapeutic expertise in specific medical fields. There is a growing understanding of the body’s healing process developing within the research functions of the business. We are realizing that there are more and more reasons for the small molecule and plasma-derived groups to work together. The reality is that over time, using a combination of our therapies in certain conditions could be a very powerful solution to some major diseases.”

Some of the therapeutics in Prometic’s pipeline could enter large markets such as diabetes and cancer. How would that affect its rare-disease focus? “In two words, it won’t!” Laurin says. “We are an orphan and rare disease business. It so happens that some of our products have promising results on major disease conditions. In these larger indications, we will partner with big pharmaceutical corporations as appropriate. Our own focus will be on marketing these smaller products ourselves, providing strong customer service to the patients we help.”

Despite the background of far-spreading success on the technology side, the soul of Prometic seems to reside solidly in therapeutics. If the soul stays strong, the company may also succeed in bringing a whole new flock of wonders into the biopharma world.

HOOKED & UNHOOKED — PROMETIC’S PROTEIN-LIGAND MIMICRY

To understand Prometic’s therapeutic in development, some knowledge of its technology platform is essential. The platform is the Plasma Protein Purification System (PPPS), which employs tiny chemicals attached to ligands that match and bond with the receptors on almost any protein. Thus, together they work as a highly efficient filter, extracting infective agents, contaminants, or even trace amounts of vital blood products from plasma, among other uses. PPPS has given rise to two main businesses for Prometic: on the technology side, as a supplier and licensor; and on the therapeutics side, for now as a developer. The founder and CEO of the company, Pierre Laurin, gives a helpful description of the technology.

“I’ll give you an analogy. You’ve seen kids in the shopping mall playing and swimming in a huge container with plastic balls and they swim in those plastic balls. In PPPS, the filter is a kind of fluid because it consists of microscopic particles or ‘balls.’ Now imagine those balls being made of Teflon, for example, so nothing sticks on them, but on them we anchor our ligands designed to bind to only a specific protein. When blood or plasma goes through the first filter, only the protein that associates by affinity to the ligands sticks to them, and everything else flows through to the second station, which does the same thing on a different protein. With blood plasma, it is sequential fractionation. Our ligands bind, but they also unbind — which is what makes it possible to harvest the extracted proteins. It is not unlike what we do in biotech, but instead of using fermentation or the milk of a transgenic cow or goat, where you derive only one drug at a time, our process handles plasma that is the source of 15 different therapeutics of interest.”