Rising Out Of Takeda's Reorganization: New Materials & Innovation

By Louis Garguilo, Chief Editor, Outsourced Pharma

As the taxi makes its way through the highway traffic to Shin-Osaka Station and the bullet train I’ll catch to head east to Tokyo, I know instinctively to look out the right-side window. Yes, it’s still there: the nostalgic off-ramp leading directly to Takeda’s former main manufacturing complex.

The company moved much of its operations from Osaka to the Tokyo area — and indeed started spreading internationally — years ago. In fact, no “Japan Pharma” has ever been more on the move than the now global Takeda.

Coincidentally, a few weeks before my visit to Japan, I received a call to my New York office from Vincent Ling of Takeda. Readers of Life Science Leader may recall that Ling (based at Takeda Boston) and I previously collaborated on an article regarding nanomedicine. When I asked Ling what came out of the reorganization recently put in place by Andrew Plump, Takeda’s new chief medical and scientific officer (CMSO), he replied: “New materials and innovation!” and let out his signature laugh. “I knew you’d be interested,” he added.

He was mirthfully correct. And readers also will be interested in learning of this practical application of Takeda’s new strategic vision.

THE MATERIALS AND INNOVATION GROUP

As part of Takeda’s broad rethinking vis-à-vis R&D, detailed recently in a separate Life Science Leader interview with Plump (by our executive editor, Wayne Koberstein), Ling was tasked with forming a new unit and then appointed senior director in Takeda’s newly created Materials and Innovation Group. “Our founding strategy recognizes you don’t have time to invest in basic research and wait 10 years,” says Ling. “You have to go find individuals and companies doing exciting research, engage them, and progress those new technologies through collaborations and funding.”

And Ling has long held his own thoughts on bringing new and more efficient therapies to patients: “Frankly, I’m not convinced the future of medicine can be based only on drug discovery. We have to be much more nuanced. There will be new modalities, such as medical therapy based on biomaterials. It’ll be great if we have drugs present in those materials, but in many cases that may not be necessary. It’s the therapy itself that counts.”

Ling’s group resides within the Pharmaceutical Sciences Department, under the direct umbrella of Formulations Development, which houses professionals who create injectables, innovate formulations, and think through delivery of the drug-molecule candidates that come out of screening. “These scientists are less tied into specific disease target areas and more into the technologies that create better therapeutics. It’s the best division of Takeda to establish a bio and nanomaterials initiative,” says Ling.

Ling also has believed for some time that those inhabiting the drug discovery arena are “so focused on equating therapy with a trendy molecule that they forget biology reaches well beyond that single focus.” He’s looking for higher acknowledgment that interactions between drug molecules are complex, and drugs widely affect physiology throughout the body. “If, on the other hand,” says Ling, “you consider implanted biomaterials can be localized to one area and have new and unique physiological interactions, that creates new research space for therapeutics. There’s a whole dimension that most early-stage drug discovery scientists haven’t fully opened up to.”

![]()

"Our founding strategy recognizes you don’t have time to invest in basic research and wait 10 years."

Vincent Ling

Senior Director, Takeda Materials and Innovation

Pictured with Matthew Phaneuf (left), President & CTO, BioSurfaces, Inc.

One reason for this relatively myopic drug-first approach in pharma is that biomaterials are generally considered as medical devices. Unfortunately, Ling also sees a challenge on the medical device end of the spectrum. “The funny thing is, inversely, the people in the medical device world don’t want to think of their materials as having drug-like properties, since the regulatory approval pathway for drugs is more arduous than for devices. That opens a whole can of worms for them; mostly they aren’t ready to deal with it.” And thus Ling — enabled by the open thinking of Takeda senior leadership — is setting out on a middle path. “We’re entering our first days to proceed independently from a therapeutic, molecule-first approach, to a pure materials- based approach for medical therapies. To the best of my knowledge, no other pharmaceutical company is doing exactly what we are doing.”

STARTING POINTS AND “S” CURVES

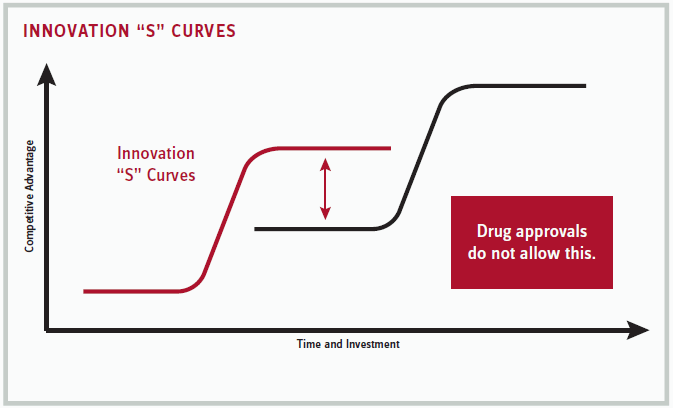

Ling, who has 20+ years of biologics drug discovery experience, has always been an ardent student of innovation. He uses EROOM’s law (Moore’s law of productivity in reverse) to graph how the cost of drug discovery has become prohibitively expensive at the same time that results — new drug approvals — have consistently diminished. Ling also employs the concept created by Clayton Christensen, made famous in his book The Innovator’s Dilemma. Christensen created a standard “S” graph plotting the life cycle of innovation from the aspects of competitive advantage and time and investment.

This innovation model starts out with little measurable activity or results (the bottom of the red “S” in the graph on page 40). At a certain point, though, research efforts break through to a scientific or technological advance, which eventually plateaus again, as technology saturates markets. PCs and laptops, whose basic function was new and groundbreaking 20 years ago, experienced this tremendous growth trend and then became a standardized commodity. These machines certainly haven’t gone away, but their innovative impact diminished, signaling the time for another breakthrough innovation, such as cell phones (represented by the second, black “S” in our graph on page 40).

Unfortunately — and a major detriment to our current drug discovery productivity — new innovation (the black “S”) typically starts from what might initially be considered an inferior point, or for niche purposes, and not at the crest of the first “S.” Cell phones were initially considered rather one-dimensional, but transformed into smartphones and other mobile devices, severely impacting the personal computing industry (not to mention the music, photography and other industries).

“This is the way everybody understands innovation in their gut,” Ling says. “Except this model does not apply to the pharma industry. It has to abide by the rules of the FDA.” What he means is drug developers cannot bring a therapy to market by starting out worse than competing standards of care; it’ll fail clinical trials. Because of the travails of trial methodology, companies attempt to “saturate their original innovation with more money and effort, for example on biosimilars and add-on combo therapies, but impacts in technological improvement are diminished.” An example of pharma’s effort to avoid this battle of diminishing returns on saturated technology is the embrace of rare diseases and unmet medical needs, where there may be no preexisting “S” curve to displace.

Circling back to Ling’s earlier point, another challenge here is in the way most pharma companies are wound tightly around core therapeutic areas. Even brilliant ideas and new relationships from outside the company must initially fit within these therapeutic groups. Pharma devises and extolls “open external research centers” and the like, but these, too, ultimately remain therapeutic-area determinate. Inventions that are slightly outside the therapeutic target area are often ignored. Therefore, Ling believes a solution lies in new thinking, such as focusing on medical treatments somewhere between drugs and material science. “That’s how I’m thinking of our new Materials and Innovation Group,” he says. “I’m proposing a middle ground for innovation that’s more open, but can still work within the regulatory and organizational constraints of the pharma industry.”

IT MIGHT NOT EVEN BE A DRUG

Still, Ling says his thinking can work within the company’s larger therapeutic framework. While his newly formed group aims to make medical therapies that don’t have to be drug-related, he can still be guided by Takeda’s core therapeutic areas — central nervous system (CNS), gastroenterology, oncology, and vaccines. “We are looking at materials innovation — new bio or nano materials and new systems of delivery — that can be applied to our core,” he says.

This doesn’t keep Ling from thinking his more expansive thoughts. He references a discussion he and I had when preparing our first article on nanoparticles (“Takeda CEO Mandate Sets Off A Nano Reaction”; Life Science Leader, April 2016). “When you mentioned the idea that nanotechnology can be the actual therapy, I could not have agreed more, and in fact have been working on that thesis,” he tells me. [Editor’s Note: Attribution for my initial understanding on this subject goes to Laurent Levy, CEO of Paris-based Nanobiotix. See “Can Nano Bring Us Back From Personalized To Mass Medicine?” Life Science Leader, August 2015]. That notwithstanding, Ling is clear there’s no predetermined path for the Materials and Innovation Group, which is starting out with a dozen or so group members, “some in the lab and others scouring near and far for external research related to material-type innovations.” The scavengers will find inventors, and the whole team will try to determine what might be “the killer application for their invention to treat the diseases we’re focused on.”

Ling’s prerequisites to garner interest and potential investment are twofold: a seed-stage entity, and a strict three-year research window. He’s looking primarily for implantables and localized therapies. “I try to avoid injecting and having systemic exposure,” he says. “I like therapies locally applied to a certain lesion in the body.” In fact, as we were preparing this article, Ling and Takeda announced they’d found their first relationship, with a company called BioSurfaces, Inc., of Ashland, MA. I then had the opportunity to bring Matthew Phaneuf, president and CTO, into our discussion. What became apparent was that this first collaboration both exemplifies the kind of company and technology Ling is pursuing, and as importantly, how his approach leads to opportunity in the first place.

ELECTROSPINNING AND BIOFACTORIES

Let’s start with the approach: Ling himself decides to attend a local (Boston) investor-pitch conference to begin evaluating different technologies. He sits in on a company presenting technology related to hemodialysis access applications. “I know Takeda won’t be interested in investing in this area; it was clearly out of focus,” Ling says, “but they are mentioning special properties of a new nanostructure material. I quickly get interested.”

Phaneuf, also seated in the audience, recalls: “Vincent asks the only question there was time for. It was focused on the healing response of our materials.” Phaneuf’s answer to that question starts up a months-long dialogue during which he says he studies “how to marry Vincent’s vision to the greatest use of our technology.” Takeda gives BioSurfaces some early feasibility studies to ensure “what they suggested really happens.” “It does,” says Ling. Now with an executed contract, Phaneuf is excited to talk about some of the technology he may get to apply to projects with Takeda, but also some thoughts for the future, including applications for nanomaterials created through a process called electrospinning.

![]()

"My pitch when we were forming our group was, ‘Hey, we’re a medical technology group. We think differently. Let’s consider going to nano and other materials, someday even to the point of having the materials be at the core of the medicine."

Vincent Ling

Senior Director, Takeda Materials and Innovation

Electrospinning is a technique by which BioSurfaces puts polymers and other materials into a solution state, and then applies a voltage as the solution is drawn out of a syringe. “We can create materials that possess excellent healing properties, and can be engineered to deliver drugs, or used to house specific therapeutic cells,” explains Phaneuf. The typical fiber diameter comprising a medical device is approximately 30 microns; BioSurfaces’ fibers can have diameters down to 0.5 microns, or 500 nanometers. “Put in perspective, that’s 120 times smaller than the average human hair, or about 1/20th the size of a human cell. This subcellular- fiber size promotes tissue healing when implanted.”

The technology can be used to deliver single or multiple drugs locally to a disease site, without requiring the fiber to break down, unlike drug-eluting stents that require the polymer to break down to release a drug. Phaneuf says a single-step manufacturing process offers the ability to load the drug throughout each fiber. “Each fiber serves as a reservoir, providing a significant amount of surface area to deliver the drug,” he explains. “This allows the drug to be released without affecting the overall healing properties of the material.”

But there’s more, and someday it could prove herculean for our industry. Phaneuf has demonstrated that these electrospun nanofibers can encapsulate cells and create a “biofactory,” which is placed at a specific location in the body. “We are talking about an implantable device with cells that continuously secrete additional proteins with therapeutic benefit,” he explains. “Basically, we’re now using the body’s own mechanism — its own nutrients — to feed the cells, and have those cells confer a local treatment over an extended period of time. The therapeutic can be released across the wall of the material and delivered to the patient, right at the site of the disease. It really is, in this regard, a working biofactory in the body.”

Of course still out there is our earlier-discussed — and perhaps most elegant — concept of all, one that would certainly delight Ling and be transformative to our industry: Have the nanomaterials themselves provide the medicinal effects via their nanostructuring. In other words, no drug need apply. And while all of this is still to be thought out and tested, it’s clear Takeda’s new Materials and Innovation Group is off to an exciting start with BioSurfaces. Ling concludes: “My pitch when we were forming our group was, ‘Hey, we’re a medical technology group. We think differently. Let’s consider going to nano and other materials, someday even to the point of having the materials be at the core of the medicine.’” He adds with his signature laugh: “Let’s rock the world.”