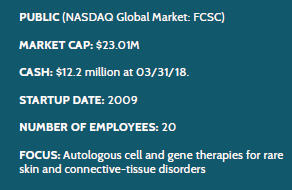

Fibrocell: Where Gene Therapy Meets Synthetic Biology

By Wayne Koberstein, Executive Editor, Life Science Leader

Follow Me On Twitter @WayneKoberstein

The Enterprisers: Life Science Leadership In Action

Biotechnology once meant only one thing — manufacturing human proteins by means of recombinant DNA applied to microorganisms, usually in fermentation. Now we speak of the life sciences, enlarging the world of biotech to encompass new technologies such as gene therapy and regenerative medicine. In The Enterprisers, as in the monthly Companies to Watch, I am now exploring that new ground, really a new geography of therapeutic areas joining and even cross-bordering with the pharmaceutical and biological therapeutics that always have been my beat. Fibrocell is developing therapeutics for rare skin disorders, using a new approach for gene therapy as a regenerative-medicine tool.

Biotechnology once meant only one thing — manufacturing human proteins by means of recombinant DNA applied to microorganisms, usually in fermentation. Now we speak of the life sciences, enlarging the world of biotech to encompass new technologies such as gene therapy and regenerative medicine. In The Enterprisers, as in the monthly Companies to Watch, I am now exploring that new ground, really a new geography of therapeutic areas joining and even cross-bordering with the pharmaceutical and biological therapeutics that always have been my beat. Fibrocell is developing therapeutics for rare skin disorders, using a new approach for gene therapy as a regenerative-medicine tool.

Rather than altering a patient’s entire genome, the company may have found a way to localize the gene manipulation to particular cells that play the central role in a targeted condition, usually expression of a key protein. In Fibrocell’s lead programs, the genetically altered cells are fibroblasts, the fundamental structural components of connective tissue and the extracellular matrix, and the proteins those cells affect. The company has specifically targeted rare monogenicskin diseases — conditions that arise because a single gene is either present or lacking, or under- or overexpressed.

In the sights of the two most advanced programs is COL7A1, the gene encoding for the protein collagen-7, a “fibril” normally anchoring the outer skin layer, or epithelia, to the layer, or stroma, underneath. The lead candidate, FCX-007 — now in Phase 1/2 development for treating the vicious condition, recessive dystrophic epidermolysis bullosa (RDEB) — consists of the patient’s own “autologous” fibroblast cells restored locally after the company uses a viral vector to insert the gene into extracted cells and “expands” them to the required volume. The second candidate, FCX-013, does essentially the opposite to treat (moderate to severe) localized scleroderma. FCX-013 carries autologous fibroblasts similarly encoded to produce the protein matrix metalloproteinase 1 (MMP-1), which breaks down collagen overexpressed in the fibrous lesions that characterize the condition.

In the sights of the two most advanced programs is COL7A1, the gene encoding for the protein collagen-7, a “fibril” normally anchoring the outer skin layer, or epithelia, to the layer, or stroma, underneath. The lead candidate, FCX-007 — now in Phase 1/2 development for treating the vicious condition, recessive dystrophic epidermolysis bullosa (RDEB) — consists of the patient’s own “autologous” fibroblast cells restored locally after the company uses a viral vector to insert the gene into extracted cells and “expands” them to the required volume. The second candidate, FCX-013, does essentially the opposite to treat (moderate to severe) localized scleroderma. FCX-013 carries autologous fibroblasts similarly encoded to produce the protein matrix metalloproteinase 1 (MMP-1), which breaks down collagen overexpressed in the fibrous lesions that characterize the condition.

To get to this point, with two products in clinical trials and others on the way, Fibrocell has spent decades creating its platform, validating its concept, and often plowing new ground as it develops its novel therapeutics. A key partnership with Precigen, a subsidiary of Intrexon, had formative effects on Fibrocell’s choice of technologies and therapeutic targets. It will take several more years to reveal the company’s fate, based on the outcome of future late-stage trials. Its lead product is still in the early to mid-stages of clinical development.

John Maslowski, president and CEO, has been with the company for almost 13 years, leading and witnessing Fibrocell’s transformation under the partnership. “The Precigen relationship had a twofold impact on us,” he says. “It shifted us into the rare-disease area, and it helped validate our technology.” The autologous fibroblast approach of Fibrocell’s lead skin and connective tissue therapies echo Precigen’s original synthetic-biology theme.

“We originally reengineered the fibroblasts and reinjected them into the patient as a cell therapy. But the Precigen component is this: Now we take a viral vector encoded in a gene of interest and introduce it to the fibroblast cells, and the cells integrate the vector gene component into its genome, which gives us the ability to deliver the cells locally where they are needed and produce the protein of interest.”

Fibrocell has been Precigen’s main collaborator on the biotherapeutics front since 2012. The two companies had formed their partnership with the intention of commercializing Fibrocell’s skin-wrinkle treatment, Laviv (azficel-T), then only the third FDA-approved cell therapy after Provenge. In addition to Fibrocell’s FDA-vetted platform for Laviv, Precigen had suites of genetic technologies, including the RheoSwitch Therapeutic System, the UltraVector platform, and other “synthetic biology” tools. The idea of combining the two companies’ platforms to produce new therapeutics became the starting point of their long-term relationship.

The collaboration began by focusing on the development of niche products for rare skin conditions and soon moved more into the gene-therapy stage with viral vectors and other related technologies. Intrexon spun off Precigen to work directly with Fibrocell to apply the combined technologies in developing new therapies. In parallel with the collaboration, Intrexon and its chairman RJ Kirk made a major investment in Fibrocell, which had the additional benefit of boosting the small company’s standing with other potential investors.

Fibrocell’s development portfolio and priorities evolved along with the Precigen relationship. But the evolution has hardly been random. The partners embarked early on a deliberate search for appropriate therapeutic targets and a selection of priorities for specific indications.

“We were embarking on a new area in dermatology,” says Maslowski. “So we looked at a lot of rare, inherited, or autoimmune disorders of the skin to see how our approaches would work. Early on, we looked at monogenic disorders because we wanted to validate the platform first for the patients, the industry, and investors. Then, the idea was that we could expand out to all sorts of other diseases on our list.”

RDEB fits the criteria as a monogenic disorder, representing a highly unmet need and with a concentrated population of highly motivated patients, caregivers, and advocates, Maslowski says. “These are all of the variables we looked at in selecting the first candidates. Precigen has the synthetic-biology portion; we have the cell-therapy portion. Autologous fibroblasts were the basis of our first product and are still largely the basis of what we’re developing today, which uses the same technology but adds the viral vector and gene therapy components to treat rare disease.”

One loose end: Although the company initially marketed Laviv, Maslowski explains how Fibrocell’s board abandoned the product after launch when it agreed to refocus the company on rare disease. “We had to decide whether to spend a lot of money to bring on a sales force and marketing team and expand manufacturing to meet demand, or take our resources and refocus them on these rare disorders. So we saw more value in the latter option. But we still have the assets for the wrinkle product, so hopefully one day we can find a home for it or bring it back in another way.” Maybe there’s a lesson here: The ability to imagine what you really can do is an important element to success.

CREATION & GENESIS

Most of the science underpinning the Fibrocell platform has taken form and evolved internally at the company. Starting in the late 1990s, the company took technology developed by a dermatologist for aesthetic uses and followed through with the concept, resulting in Laviv. Later came the change to development of the autologous fibroblast technology for medical uses.

For its lead product, FCX-007, the company chose an especially dramatic indication in recessive dystrophic epidermolysis bullosa — a rare blistering disorder where the skin separates to create terrible blisters and wounds all over the body. The disorder affects only about 2,000 patients in the United States, but it looms large in my mind as one borne by a set of young female twins I knew in the 1970s, one of whom had already lost a leg to out-of-control disease- caused skin wounds.

The problem is lack of collagen-7, the protein that serves to bind the skin together. Once processed to carry the related gene, FCX-007 is injected locally and intradermally around the periphery of wounds where they promote expression of collagen-7 and act like a zipper to reattach and close the skin, allowing the wound to heal. The FDA has granted FCX-007 Orphan Drug, Rare Pediatric Disease, and Fast-Track designations.

FCX-013, in development for treating moderate to severe localized scleroderma, is injected into the related lesions to suppress collagen-7, as already described. The systemic form of scleroderma is invariably fatal, but the type localized on the skin, though not fatal in itself, causes significant morbidity from developmental issues with the lesion-deformed skin, such as severely malformed limbs, ocular conditions, and neurological disorders, along with incredible pain and a range of associated emotional problems.

FCX-013 is now heading into Phase 1/2 trials with both Orphan Drug and Rare Pediatric Disease designations granted by the FDA. According to Maslowski, the company also will take the next step in seeking Fast-Track status to further speed its review.

Among three of the four RDEB patients dosed in the Phase 1 portion of the trial for FCX-007, Maslowski says the product was well-tolerated up to 52 weeks postadministration along with “encouraging signs” in wound closure. Of course, RDEB has more than one component in addition to the lesions Fibrocell targets. The twins I knew dealt constantly with large skin patches sluffing off as after a bad sunburn and other, even more serious complications. Other academic centers and companies are attempting gene therapy that may address those aspects of the disease.

“When we first started work on this disease, no one else seemed interested, so it is exciting to see how others have come along since then to address the disease from different angles,” Maslowski says. “What we envision in our clinical development is creating the circumstances that promote wound healing in RDEB — induce a wound-healing response, and then see a proliferation of wound healing. Our approach may have some other benefits as well; we’d like to see our therapy used preventatively, in intact skin areas in the future, so those areas don’t evolve into a wound.”

That would be a much different and probably more difficult endpoint, of course, so it made sense for the company to start with a more obvious clinical benefit in the clinical trials. “After that, we can develop other applications for other areas where it might be used, such as the interdigital areas around fingers or the mucosa,” says Maslowski. “RDEB patients can have a variety of other biological issues such as organ problems. Wounds can evolve into squamous cell carcinoma as the disease persists over their lifetime, which is fatal within five years for 92 percent of patients — it’s terrible.”

LOGISTICAL DAYLIGHT

Thanks to the brief commercial life of Laviv, Fibrocell already has an in-house GMP manufacturing plant, just outside Philadelphia in Exton, now set up for processing enough FCX-007 to fill RDEB demand in the United States. In a nutshell, the logistics for the novel gene therapy are simple — tissue is collected at the doctor’s office, sent to the facility, and used to engineer the autologous fibroblasts, which are then sent back for administration at the doctor’s office.

Adoption of the therapy in practice faces some challenges. The treating physicians for RDEB are generally pediatric dermatologists, who traditionally have been skeptical that anyone could scale up an autologous process to treat the disease. But some traditional practices, such as the physicians’ long-term refinement of biopsy procedures, fold neatly into the FCX-007 routine, as Maslowski describes.

“The patient goes to the clinic, where a clinician takes very small biopsies, which are actually pretty well tolerated. The samples come to our Exton facility and go through our cleanroom, the GMP space, where the fi- broblasts are isolated, expanded, and along the way introduced to the viral vector, which copies the COL7A1 gene into each fibroblast cell. Then the cells are expanded further so we have many more cells that carry the copy. Then we cryopreserve the cells. Each patient has a personal cell bank to supply multiple treatments. When the cells are needed, we thaw them and expand them a bit more, then collect, harvest, and ship them overnight at refrigerated temperatures to the site.”

The preservation of engineered fibroblasts for each patient only makes sense because RDEB constantly creates new wounds around the body. “It’s not going to be a one-and-done treatment,” Maslowski says. “It’s not like a CAR-T where you get the gene-altered cells in a single shot, and that’s the end of it. It’s very heterogeneous: you have patients who have a few wounds; you have others who are fully covered in wounds, up to 90 percent of their body or more. It probably will be a bell-shaped curve.”

Some patients will come back for treatment multiple times per year because of complications, including needed surgeries, and would likely have new skin wounds treated with FCX-007 at the same time. But the company also hopes for a lasting effect in the treated areas and has seen some evidence of that in clinical trials.

PROGRESS TO PEDIATRIC

As the RDEB program shifts from the first to the second portion of the Phase 1/2 trial, the company will be enrolling children for the first time, adding to the adult-only populations it has studied in Phase 1. Fibrocell has followed the FDA’s direction to add pediatric patients to the trial only after the company produced more safety data and perhaps some indication of benefit. In late January of this year, that evidence was sufficient to obtain the agency’s permission to initiate enrolling children in the Phase 2 portion of the trial.

Product candidates for treating genuinely rare diseases have tiny trials. The Phase 2 of the trial of FCX-007 is targeting six patients. Despite the small scale of the trial, Maslowski sees the agency’s decision on inclusion of children among that number as a major milestone for the company. Another milestone was the January 2018 IND filing for FCX-013 to the FDA, and in March 2018, the agency allowed the IND to progress to a Phase 1/2 clinical trial of FCX-013 for the moderate to severe scleroderma indication.

Phases 1 and 2 may sound a bit too early for talking to payers, but Maslowski has already opened a dialogue with major reimbursement players, and the feedback he received from them says to him, “There is no ‘too early.’” The principle may be true in general, but it especially applies to complex therapies like the ones his company aims to offer one day.

“Traditionally, you wait until you have your clinical data and then your BLA [biologic license application] or your NDA underway, and then you start talking. But with a complex product, you may have to deal with ‘pay for performance,’ annuities, or other complications. Once we have some Phase 2 data, we may start doing a form of economic analysis. We’re not that far down the road yet, but we are already thinking about what’s the right way to deliver this treatment to patients. We want to make sure it’s successful.”

By current plans, the product for RDEB will be something like an ampoule or vial of the cells suspended in a fluid solution, which is drawn into a syringe and locally injected. The idea is to keep things simple for anyone administering the cells in an outpatient setting.

Maslowski also advises companies to start a dialogue with the FDA early in development and take advantage of all appropriate incentives. When you’re not only developing a new therapy, but a new kind of therapy, that advice may apply all the more.