Industry Research

The data shown on this page comes from Industry Standard Research (ISR), a full-service market research provider to the pharma and pharma services industries.

-

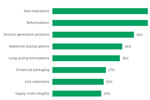

Top 10 Reasons For Oral Dose CMO Preference

Just under one-third of respondents who participated in ISR’s Oral Dosage Forms Market Outlook research shared that Familiarity/History of working together/Prior positive experience are the reasons behind their preferences.

-

CDMO Engagement Timeline For Gene Therapy

In ISR’s inaugural Gene Therapy CDMO Benchmarking Report, we asked respondents to identify the stage in which their company would typically engage a CDMO to support their gene therapy manufacturing needs.

-

Sterile Injectable Life Cycle Management

In a recent study on the market outlook for sterile injectable drug product manufacturing, ISR asked respondents whether their company is investigating improving or extending the life cycle of sterile injectable drug products in their portfolio.

-

How Do Outsourcers Feel About The CDMO Industry?

Now is the time for company leaders at all stages to evaluate insurance costs, which can be among the top five most significant budget line items.

-

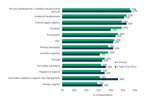

Benefits Of Clinical Development Outsourcing Models

ISR’s Clinical Development Outsourcing Models (5th Edition) report examines three outsourcing models commonly used in the clinical trial space. Respondents provided feedback on the benefits of each outsourcing strategy currently used at their company.

-

Which CDMO Traits Predict Sponsor Loyalty When Outsourcing Small Molecule API?

Using data from Industry Standard Research’s Small Molecule API CDMO Benchmarking report, ISR ran a regression analysis to identify which contract manufacturer characteristics are most-closely related to sponsor loyalty.

-

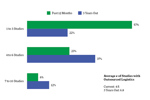

Cell & Gene Therapies Manufacturing Market Outlook

In ISR’s Cell & Gene Therapies Manufacturing Market Outlook (2nd Edition) research participants were asked to select the cell and gene manufacturing activities their company would outsource to CDMOs in the next 18 months and in five years.

-

Cell & Gene Therapies Manufacturing Market Outlook

In ISR’s Cell & Gene Therapies Manufacturing Market Outlook (2nd Edition), we asked respondents to rank their top three satisfaction drivers regarding a CDMO’s performance in cell and/or gene manufacturing activities.

-

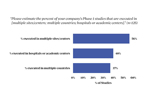

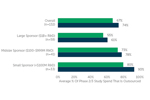

Attributes Gaining Importance When Selecting Among Preferred Providers For Phase 1 Services

The service provider selection process is a complicated one. Many factors come into play during this process. One critical factor is undoubtedly the presence of preferred provider agreements. Companies can spend a great deal of time negotiating these agreements, and their presence, or lack thereof, can make or break which CROs are shortlisted or awarded a Phase 1 study.

-

Clinical Manufacturing Market Outlook

In ISR’s Clinical Manufacturing Market Outlook report, we asked sponsors about their top reasons for being satisfied with an outsourced clinical trial manufacturing project.

-

Decentralized Clinical Trial Predicted Use

Though not all respondents to ISR’s Decentralized Clinical Trials Market Outlook reported a smooth experience, nearly 60% came away with a positive overall impression of DCTs.

-

COVID Continues To Impact Outsourced Manufacturing And Supply Chain Security

ISR shares results from its annual benchmarking surveys on how the COVID-19 pandemic has impacted outsourced manufacturing over the past three years as well as how drug innovators plan to reduce risk and improve supply chain security going forward.

-

How Well Are CDMOs Performing On Sponsors' Most Important CDMO Selection Criteria?

Focusing on the 20 common CDMO attributes that serve as both selection drivers and also performance metrics, ISR compared how well contract manufacturers are performing on the criteria that matter the most among sponsors.

-

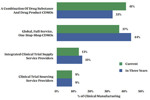

Clinical Manufacturing Volume By Service Provider Category

When it comes to outsourced clinical manufacturing, respondents allocate the largest proportion of project volume to a combination of drug substance and drug product CDMOs.

-

Phase 1 Study Complexity

ISR recently ran a survey to assess dynamics in the Phase 1 clinical development space. Over 80% of respondents believe Phase 1 studies are getting more complex.

-

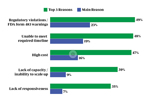

The Top Reasons Bioprocessing CDMOs Lose Bids

Respondents continue to report that service providers primarily lose bids for bioprocessing efforts due to regulatory violations/FDA form 483 warnings, their inability to meet required timelines, and high cost.

-

Preferred Provider Agreements At Small & Emerging Sponsors

While preferred provider agreements are an important piece of the provider-selection puzzle in many parts of clinical development, this is not necessarily the case among small sponsors.

-

Where Bioprocessing Outsourcers Stand On Capacity Concerns

Insights into bioprocessing outsourcers’ level of concern regarding current and upcoming available capacity, whether they are currently facing limits, and what they plan to do about a potential shortage.

-

Outsourced Proportion Of Phase 2/3 Spend

ISR recently ran a survey to assess dynamics in the Phase 2/3 clinical development space. Survey respondents reported that, on average, two-thirds of their company’s spend on Phase 2/3 studies over the past year was outsourced.

-

Volume Of Trials With Outsourced Clinical Logistics

ISR’s Clinical Logistics Market Dynamics report provides details on drug developers’ use of the various types of service providers available for outsourced clinical logistics.

IN THIS MONTH'S ISSUE

- Gene Editing Versus Gene Therapy: Is There A Difference?

- The Ozempic Dilemma: What Makes A Dual Brand Approach Viable?

- Ensuring Diversity And Accessibility In Neurological Research

- A New Year's Resolution Suggestion For The FDA

- Pharma's Customer Engagement Evolution: Is Your Data Governance Keeping Pace?

- 2023 ADC Roundup: A Year Of Collaboration And Licensing Deals

- Five Financial Strategies Life Sciences Companies Should Consider

- Evolving Business Models: Pharmaceutical Incubators

- An Uncertain Future For Interchangeability

- Life Sciences M&A Outlook: Challenges And Opportunities In 2024

- Defining A Competitive Next-Gen RNA Therapeutic In 2024

- Top 2024 Clinical Trial Site Challenges: Staffing & Technology

- Accelerating Drug Development With Real World Data

- Biopharma's Eminent Challenges In 2024 — Inside & Out

BEYOND THE PRINTED PAGE

-

2023 Manufacturing And Supply Chain Outlook: Additional Insights12/16/2022

Additional executive responses to our 2023 manufacturing and supply chain outlook questions.

-

2023 Finance And Funding Outlook: Additional Insights Part 212/9/2022

Additional experts weigh in on Life Science Leader's 2023 finance and funding outlook questions.

-

2023 Finance And Funding Outlook: Additional Insights Part 112/2/2022

Biopharma executives offer options, tips and strategies for navigating finance and funding challenges in 2023.